Importando pelos

Correios

de forma prática e segura

Shipping to

Brazil

Tips from Correios

• Upon arrival in Brazil, all objects are inspected by the Federal

Revenue Service and other agencies before formally entering the

country.

• Depending on the imported merchandise, the approval of a

control body may be necessary to enter the country.

• For that reason, it is important to check the list of prohibitions

and restrictions on imports in Brazil, available on the Correios

website.

• The customs clearance process takes, on average, 3 working days

to be completed.

• In case there is a tax or service charge, the recipient has up to 30

days to make the payment through Correios's website or app.

• Stay tuned! Correios only delivers the parcels after they are

released by the inspection agencies.

Before shipping to Brazil,

keep in mind that…

• Correios only delivers the parcels after they are released by

the inspection agencies.

• The Federal Revenue of Brazil requires the Taxpayer

Identification Number (CPF) on all shipments. This number

must be informed at the moment of the purchase, directly

on the website of the online store, as well as a telephone

number, for identification of the package on arrival in Brazil.

Packages that do not contain the proper identification of the

CPF are subject to return to the country of origin.

Before shipping to Brazil,

keep in mind that…

Shipping methods

to Brazil

EMS (Express Mail Service)

Faster method offered.

Estimated delivery time (average) - 3 working days.

Tracking of all stages of delivery.

Proof of delivery with the signature of the recipient.

Maximum weight of 30 kg.

Tracking codes start with the letter “E”.

Correios Packet Express (Brazil Direct Mail or Brazil

Priority Line)

Estimated delivery time (average) - 4 working days.

Tracking of all stages of delivery.

Proof of delivery with the signature of the recipient.

Maximum weight of 30 kg.

Tracking codes start with “IX”.

Compare shipping options and their features before

choosing!

Express shipping methods

Shipping methods

to Brazil

Correios Packet Standard (Brazil Direct Mail, Brazil

Priority Line)

Estimated delivery time (average) - 12 working days.

Tracking of all stages of delivery.

Proof of delivery with the signature of the recipient.

Maximum weight of 30 kg.

Tracking codes start with “NX”.

Standard shipping methods

Economic Merchandise (Colis Postaux)

Low cost.

Estimated delivery time (average) - 12 working days.

Tracking of all stages of delivery.

Proof of delivery with the signature of the recipient.

Maximum weight of 30 kg.

Tracking codes start with "C".

Prime Exprès

Low cost.

Tracking of all stages of delivery.

Maximum weight of 2 kg.

Tracking codes start with "L".

International online stores normally use the designations "Priority

Mail" and "e-Packet".

Shipping methods

to Brazil

Small orders registered

Extended delivery time.

Limited information on delivery stages.

Maximum weight of 2 kg.

Proof of delivery with the signature of the recipient.

Tracking codes start with "R".

International online stores normally use the designations "registered

mail", "small parcels" and "small packets".

Economic shipping methods

Shipping methods

to Brazil

Extended delivery time.

No tracking.

Maximum weight of 2 kg.

No information on delivery stages.

Identification codes start with “U” (used only for payment of taxes

and Postal Dispatch).

Simple small orders

Simple small orders are not recommended for buyers who need

to follow the delivery steps or to receive the order quickly.

The modalities offered as "free shipping" usually do not include

the option of tracking or do not have complete traceability.

The longer the delivery time, the lower the freight cost usually

is.

International online stores normally use the designations

"unregistered mail", "small parcels" and "small packets".

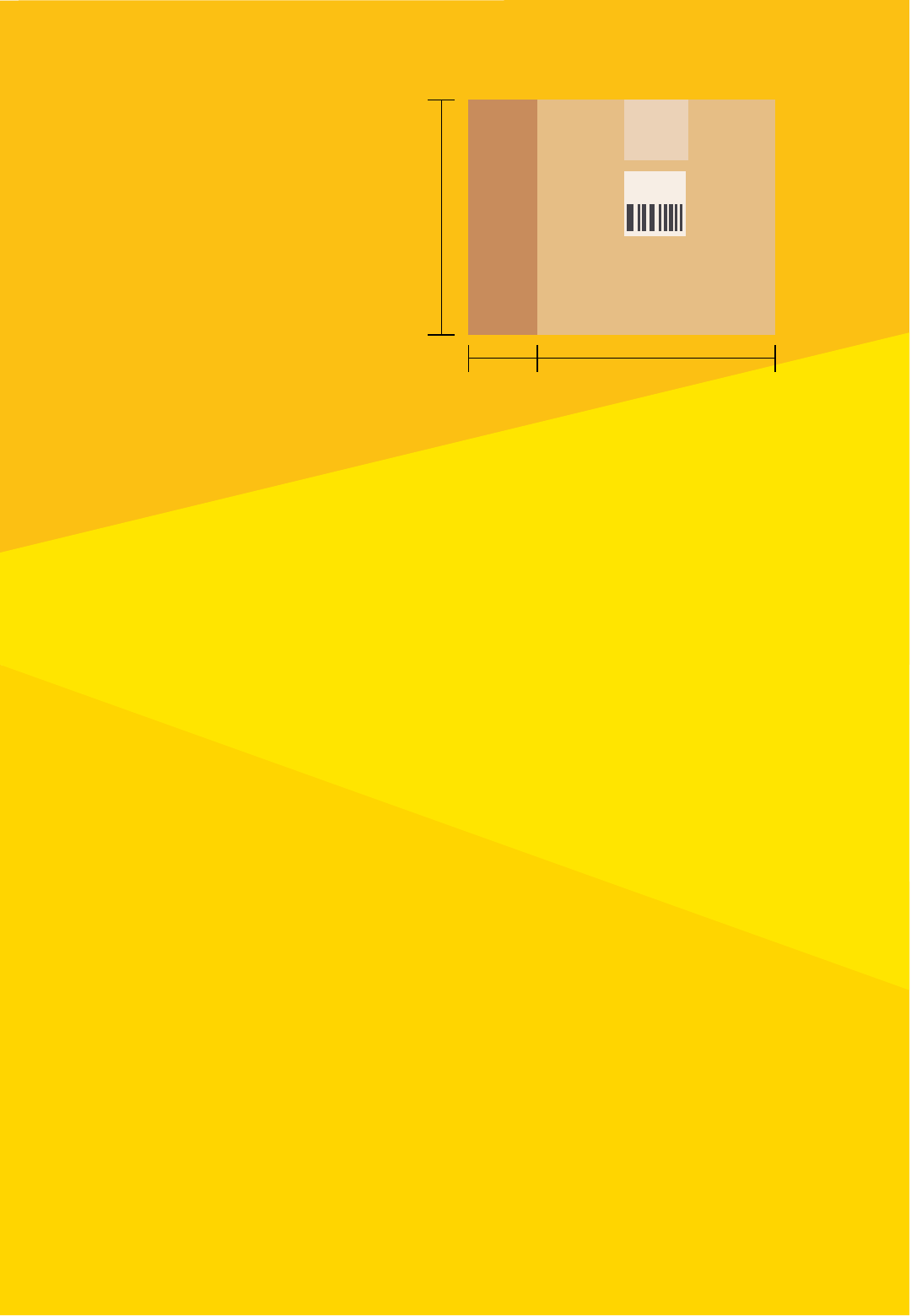

Limits

a

c

b

a = length

b = width

c = height

Values

Up to USD 3,000 per shipment or USD 100,000 / year

What is the maximum weight?

30kg (EMS, Packet and Economic Merchandise)

2kg (Small Orders and Prime)

What are the maximum dimensions?

The largest dimension cannot be greater than 1.05m

The sum of the perimeter (width + width + height + height) + length

must be less than or equal to 2.00m

Orders that do not respect the size limits will be

returned to the country of origin.

When will the order be shipped to the recipient's

address?

After the confirmation of payment of taxes (when applicable) and Postal

Dispatch (Import Support), and after the release by the consenting bodies,

when applicable.

How to track the order?

In the Correios tracking system.

Delivery time

What is the delivery time?

It varies according to each shipping method and the destination zip code.

See average delivery times here.

The delivery time only starts to be counted as soon as the order is

shipped from the Correios International Office in Brazil.

According to Brazilian law, all objects are subject to taxation.

International postal shipments are cleared by the Federal

Revenue of Brazil under the Simplified Taxation Regime - RTS

up to the value of USD 3,000.00 per package.

In this taxation regime, there is a single tax rate for imports,

being 60% of the customs value of any product.

How the tax is calculated:

The basis of calculation is: Value of goods + Shipping +

Insurance.

Tax exemption is provided in the following cases:

• parcels sent from individuals and destined to individuals,

whose customs value does not exceed USD 50 and are sent

exclusively as gifts;

• medications for personal use;

• books.

Taxation in Brazil

Taxes in Brazil

Correios acts with the Federal Revenue Service in the

customs clearance of imported goods based on the

Simplified Taxation Regime (RTS).

What is customs clearance?

It is the release of merchandise by customs for entry

into Brazil.

What taxes are charged on the order?

Import Tax and ICMS, when applicable.

What is RTS?

The regime adopted for customs clearance of imported

international orders with a customs value of up to USD

3,000.00, upon exclusive payment of Import Tax and ICMS

(when applicable).

What is the customs value?

Value on which taxes are fixed. It consists

of the purchase price + freight price +

insurance value (if any).

Who can import using RTS?

Individuals and legal entities.

What are the tax rates?

Import Tax: 60% on the customs value.

ICMS: varies according to the order's destination

state.

Who charges?

Taxes are established and collected by the

competent authorities, which are the Federal

Revenue Service and the State Tax Authorities.

Thus,

100% of the taxes paid to Correios are passed

on directly to the aforementioned legal

entities.

For merchandise with a customs

value greater than USD 3,000.00,

Correios only executes the

transport. Thus, the recipient must

hire his own dispatcher so that

customs clearance can be provided

in these cases.

How to pay?

Online, on the website

Minhas Importações.

%

Postal

Dispatch

Import Support

What is it?

Import support service paid by importers for the

administrative support that Correios provides to

the customs treatment activities of international

orders.

What is it for?

To cover costs of activities that Correios performs and that go

beyond the freight/transport of international parcels, such

as, for example, x-ray inspection, collection and transfer of

taxes, communication with the recipient and sender, and

return to the country of origin.

How do I know if the payment is pending?

Consult the order tracking system. When payment is required, the

tracking system will inform “Waiting for payment of Postal Dispatch”.

How to pay?

When clicking on “Pay” in the tracking system, the Brazilian importer

is redirected to the Minhas Importações website, where the payment

must be made.

What is the deadline for payment?

30 days.

Find out more information here.

Postal

Dispatch

Import Support

How do I know if a product has any restrictions for

sending it by post?

Before shipping to Brazil, check if it is allowed to import by posting the

desired product in the List of prohibited and accepted under condition

objects for import.

What happens if I send a prohibited product?

The order will not have its entry in Brazil authorized by the competent

authorities.

What does it mean to be accepted under conditions?

It means that the order will be evaluated by the responsible consenting

bodies before entering Brazil. Examples of consenting bodies: the Army,

Anvisa (National Health Surveillance Agency), Inmetro (National

Institute of Metrology, Standardization and Industrial Quality), etc.

Prohibited Products

and accepted under

conditions (consent)

Products accepted under conditions may be

subjected to a longer inspection period.

Do medications

pay tax?

What information should the prescription provide?

● Information regarding the patient's name and address;

● Dosage;

● Treatment period (limited to 180 days);

● Date and signature of the responsible professional, his

residential or professional address.

Prescription drugs for individuals are not subject to tax.

The medical prescription must be written in

Portuguese and affixed to the outside of the

package.

Medications for personal consumption will be allowed into the

national territory in an amount and frequency compatible

with the duration and purpose of use.

Did you know?

In 2020, Correios reached 1st place in the

CrossBorder and Customer Service categories in the

international award World Post and Parcel,

considered the “Oscar” of the Postal Industry

worldwide with postal and private companies in the

logistics sector, with the New Import Model (Minhas

Importações) for the digital transformation it

offered to all Brazilians, together with the new

import services Correios Packet and Compra Fora.

The countries that most send orders to Brazil are

China and the United States. The shipping method

most used by Brazilian importers is Prime Exprès,

which tracking code starts with the letter "L". The

fastest-growing shipping method in 2020 was the

new Correios Packet service, which tracking code

starts with the letters IX or NX.

Correios deliver around 300,000 international

orders per day in any city or region of Brazil,

allowing access to international e-commerce to

all Brazilians with internet access. In November

and December, this volume can reach 600,000

orders/day. Each month, about 3,000 tons of

imported packages are delivered by Correios,

equivalent to 3,000 popular cars.

https://www.correios.com.br/english/export-

import/imports

To learn more, visit: