THE FUTURE

OF ECOMMERCE

IS NOW

Industry Insights for 2023 & Beyond

Introduction

Since the start of the COVID-19 pandemic,

trends in ecommerce have continued

evolving. In 2020, the industry witnessed

a massive boom as consumers searched

online for everything from entertainment

to groceries. But as lockdown measures

eased → and vaccination rollouts continued

through 2021 and 2022 →, growth

in ecommerce continued, though

at a slightly slower pace.

In 2023, the ecommerce industry faces

a new set of opportunities and challenges.

While interest rates continue fluctuating

and the possibility of a widespread global

recession remains, 2023 has also brought

some exciting technological advancements

that are shaping the industry in surprising

ways.

While the future looks hopeful, many

questions remain: How is the ecommerce

industry responding to economic

uncertainty?

How can ecommerce businesses stay

competitive in an increasingly crowded

landscape?

In this report, we seek to answer these

questions and more using ecommerce

industry traffic data from Semrush

Open .Trends → and Semrush .Trends →,

and Amazon-focused data from Semrush’s

Keyword Wizard for Amazon tool →.

The data primarily spans from March 2022

to March 2023. While we touch on most

regions across the globe, the report

specifically focuses on global data

generally and U.S. data specifically.

In assessing the ecommerce industry

in depth and highlighting some overarching

ecommerce trends that will likely stick

for the long haul, we hope to help you shape

a smarter, insight-driven digital marketing

strategy for your ecommerce business

in years to come.

02

The Future of Ecommerce Is Now

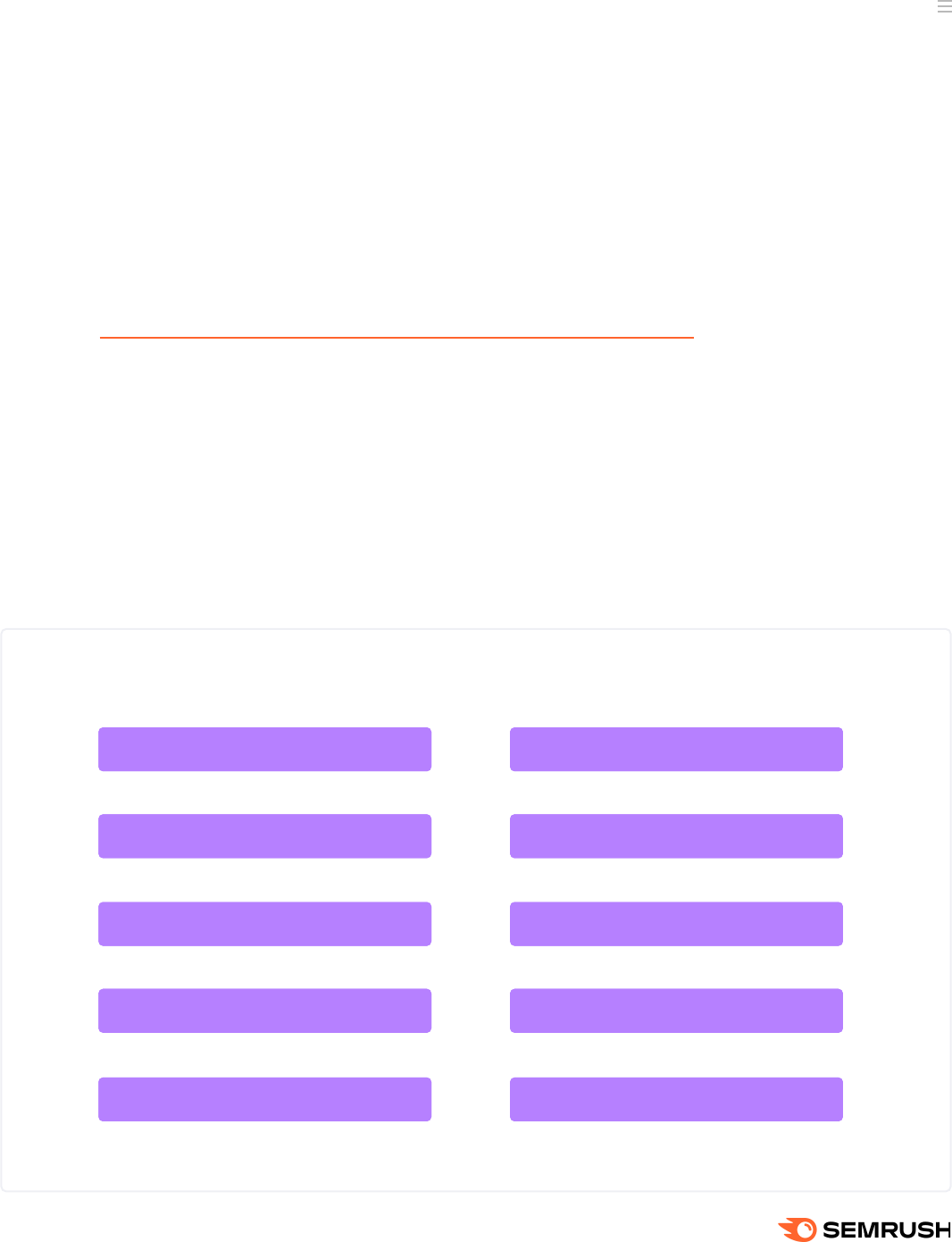

Table

ofContents

02 Introduction

04

Global Ecommerce Growth Dynamics

07 Ecommerce Industry Traffic Share by Country

09

The Ecommerce Industry

Market Landscape

10 The Top Global Ecommerce Players

12 The Top U.S. Ecommerce Players

14 Ad Spending for Top U.S. Ecommerce Players

15 Top Ecommerce Players by Region

17 Ecommerce Market Position Dynamics

18 The U.S. Ecommerce Competitive Landscape

20

Apps Data

21 The Top 10 Ecommerc Mobile Apps

Worldwide

24

Ecommerce Shoppers’ User Behavior

25 Ecommerce Industry Traffic Trends by Device

(Global)

26 Ecommerce Industry Traffic Trends Global

28 Ecommerce Industry Traffic Trends U.S.

29 Social Media

29 The rise of TikTok

32

Artificial Intelligence, Augmented

Reality and the Future of Ecommerce

35 Most Wanted Products and

Calls-to-action

36 Ecommerce Industry Top Products

37 Top Emotional Triggers Featured in Leading

E-Tailers’ Ads

40

The Giant on the Market: Analyzing

Amazon.com for Insights

41 Average Funnels

42 “Special Occasions” Funnels

44 Top Trending Products on Amazon.com

in 2022-2023 by Month

45 Top Products on Amazon.com in 2022-2023

48

Insight-driven Recommendations for

Shaping Your Future Ecommerce

Marketing Strategy

The Future of Ecommerce Is Now

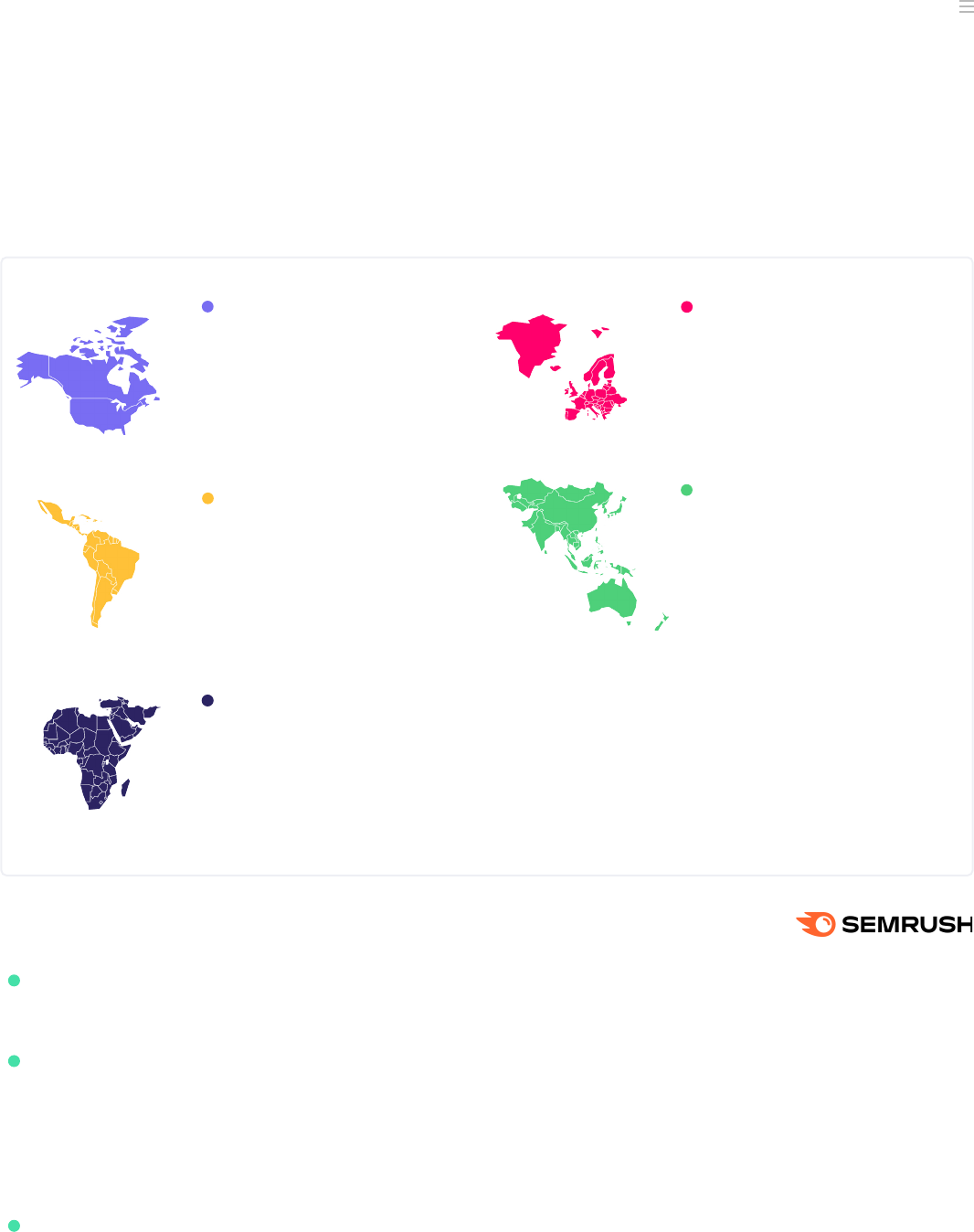

Global

Ecommerce

Growth

Dynamics

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

25 B

20 B

15 B

10 B

5 B

0

Jan’19 Jan’20

Jan’21 Jan’22

March’23

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

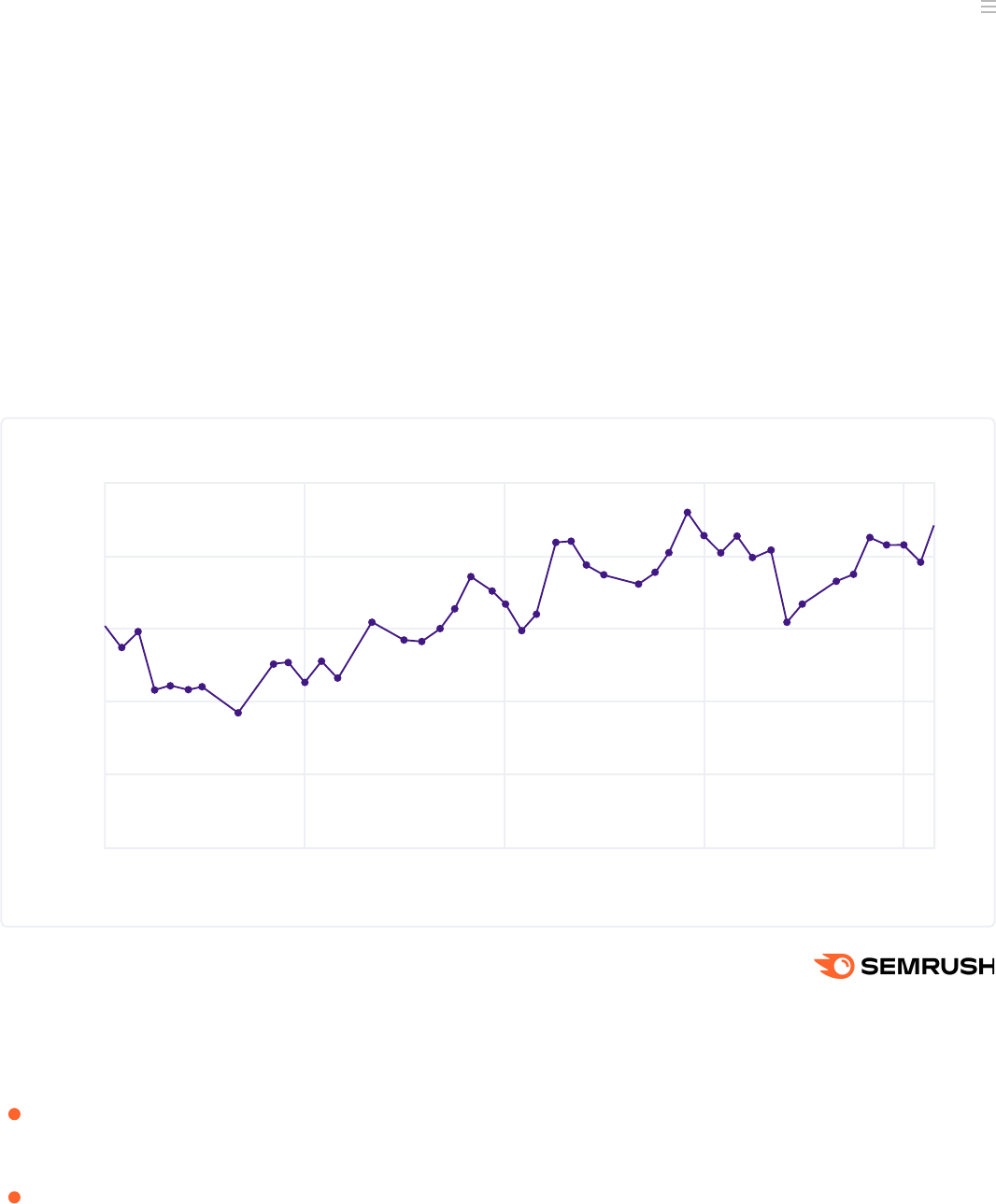

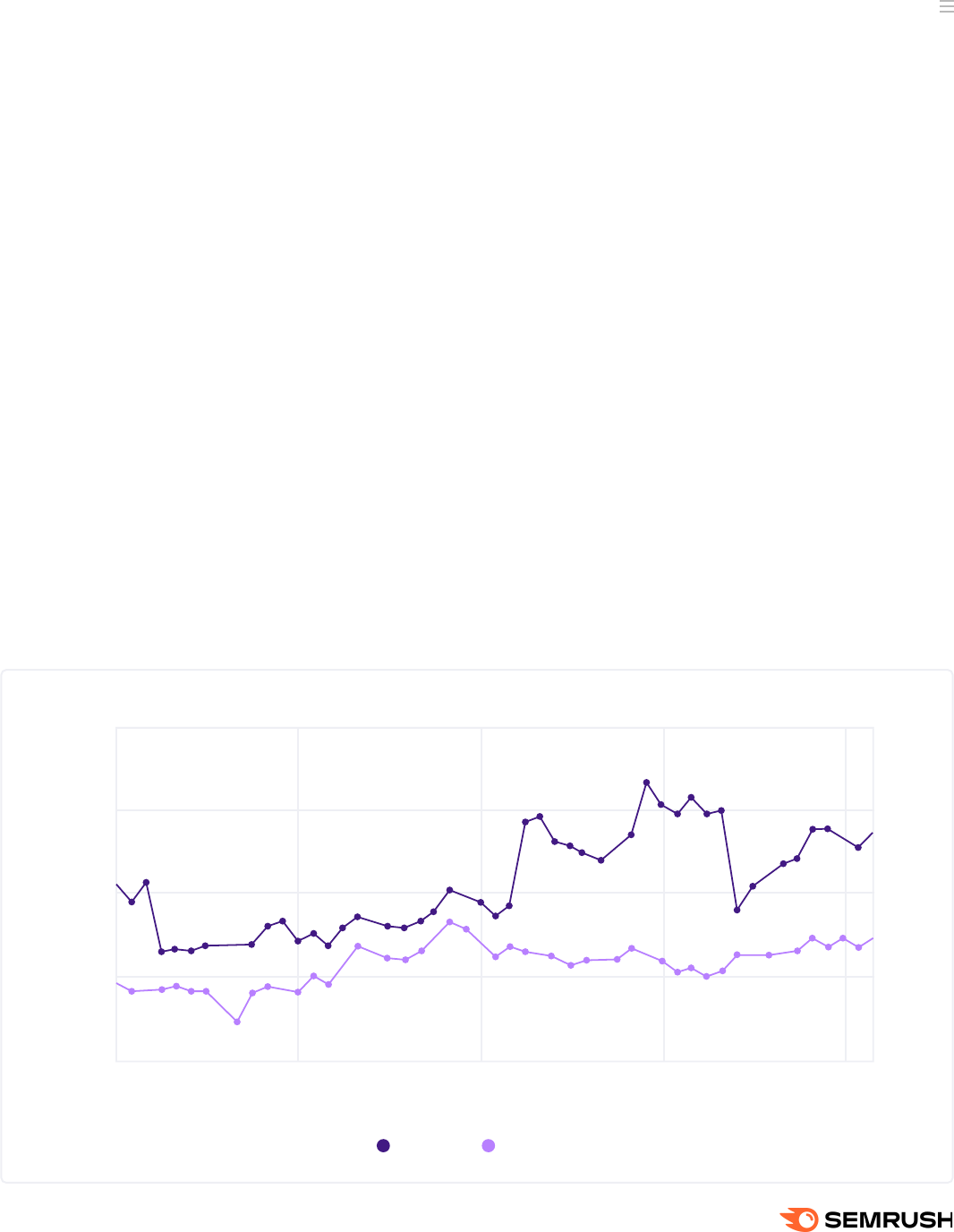

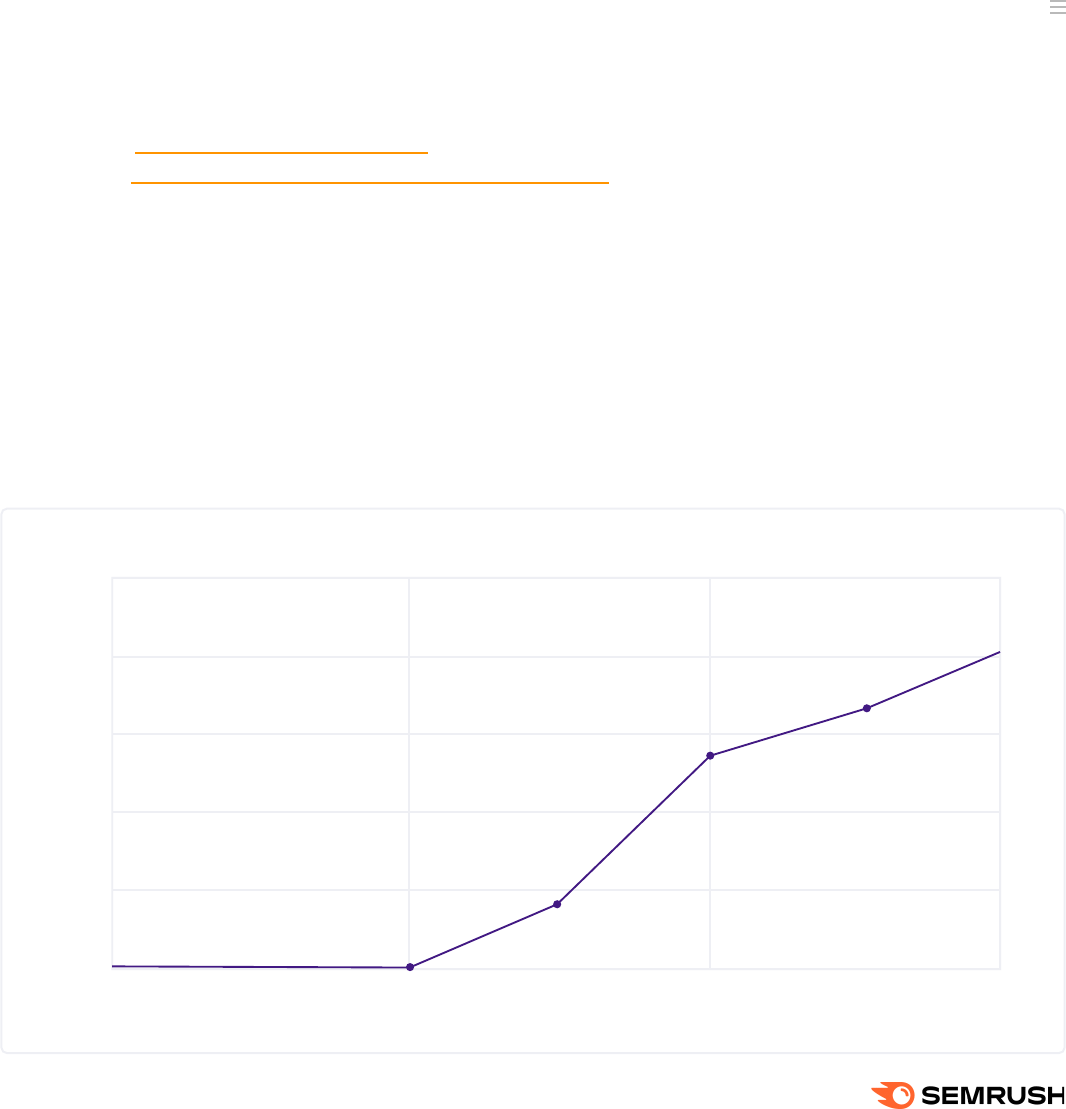

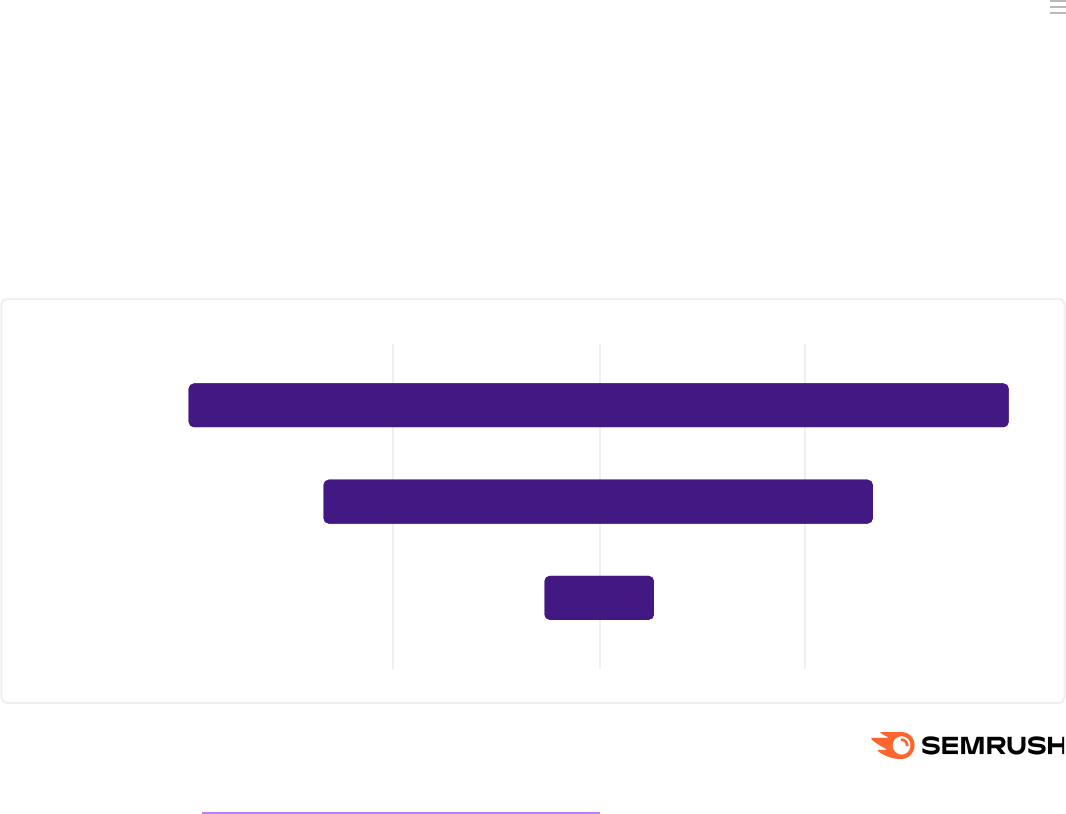

Global Ecommerce Growth Dynamics

Ecommerce Industry Traffic Trend

Global 2019-2023

Over the past decade, the ecommerce industry has experienced

a meteoric rise. Whether you look at revenue or web traffic, the results

are clear: shoppers are turning to the internet at an increasing rate to make

purchases of all shapes and sizes.

While COVID undoubtedly added momentum to ecommerce growth, expansion of the industry has

continued even as the intensity of the response to the global pandemic has decreased.

A top massive gains seen in 2020 and 2021, year-over-year traffic trends showed a steady

2.5% increase in 2022

While traffic slowed down from previous years in 2022, the three-year average growth

remained at an impressive 18%

05

The Future of Ecommerce Is Now

Looking to 2023, we see positive signs for continued growth. After a dip in traffic during

the summer months of 2022, traffic rates made a full recovery by the start of 2023.

By the end of Q1 of 2023, traffic was up 8% in the ecommerce industry

Traffic highs in March of 2023 were higher than all of 2022 and nearing all-time industry

highs seen in December of 2021

Looking at seasonal trends, 2023 could be another record breaking year for the industry, especially

when the year-end shopping season is taken into account

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ecommerce Market Growth

Global 2022

As the Market Size graph shows, the SAM for the ecommerce industry grew by 100M between April

and December of 2022, which reflects the massive growth the industry sees around the holiday

season.

Overall, trends in the ecommerce industry traffic suggest a continued upward trajectory, even

as the pandemic continues to fade into the background of consumers' lives. While we may not see

the steep upticks in traffic witnessed in 2020 and 2021, 2023 is poised to show continued growth,

with the potential to bring industry traffic to new all time highs.

Market Size

7B

1.2B

7B

1.3B

06

The Future of Ecommerce Is Now

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

United States

Germany

United Kingdom

France

India

Brazil

Japan

Italy

Spain

Netherlands

Country Traffic Share

2022

50.22%

4.14%

4.12%

3.15%

3.05%

2.75%

2.08%

1.98%

1.97%

1.58%

United States

India

Germany

United Kingdom

Brazil

France

Turkey

Japan

Philippines

Spain

Country Traffic Share

2023

31.21%

8.43%

5.22%

4.98%

3.58%

3.42%

3.06%

2.54%

2.45%

2.21%

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ecommerce Industry

Traffic Share by Country

Ecommerce Industry Traffic Share by Country

2022-2023

Between 2022 and 2023, the ecommerce industry witnessed some significant shifts in traffic

share by country. The U.S. maintained its position as the leader across both years with a wide lead

on the other countries listed.

Looking at growth in the industry’s digital advertising spending in the U.S. → provides a clear

view of the breadth and growth of the industry in the U.S. Since 2019, ad spending has more than

tripled, going from 12.5B in 2019 to an estimated 38.4B by 2024.

Between 2022 and 2023, however, the U.S. has seen a significant drop in traffic share while other

countries have witnessed strong gains. Comparing traffic stats between 2022 and 2023 reveals

some significant shifts.

07

The Future of Ecommerce Is Now

Get customized ecommerce

market data

TRY NOW

Overall, global ecommerce traffic shares are seeing major shifts in 2023. The US, which has

historically held the top spot, experienced significant losses, along with several European countries

that have traditionally captured a large share of the market.

In 2023, the countries making the biggest moves are located in Asian markets. With economies

in India → and The Philippines → continuing to show resilience and growth in the face of global

economic uncertainty, they represent a tremendous opportunity for the ecommerce industry

in 2023 and beyond.

Over the last year, the U.S. saw a 19% decrease in traffic share year-over-year, dropping

from 50% in 2022 to 31% in 2023.

India experienced a significant increase in web traffic from 3.05% in 2022 to 8.43% in 2023,

making it the second-highest country for web traffic in 2023. This upward movement

knocked Germany into spot number 3 on the list.

The Philippines made the top 10 list for web traffic to ecommerce domains in 2023,

capturing 2.45% of the global traffic share. The Philippines represents one of the fastest

growing ecommerce markets → across the globe.

Spain, the Netherlands, and Italy saw traffic shares decrease in 2023. All three European countries

lost their spots on the top 10 list.

08

The Future of Ecommerce Is Now

The Ecommerce

Industry Market

Landscape

Through the pandemic, an increasing consumer focus on ecommerce was a major boon

for companies prepared to meet their needs. In 2020, the companies that saw the most

revenue growth–which included the likes of Amazon and Ebay–witnessed profits soar

into the double digits → across the board.

With so much money on the table, many brick-and-mortar companies turned their

attention to digital markets. For example, brands like Walmart and Target stepped up

their ecommerce game and saw massive growth →.

But as the playing field has become more crowded, competition has grown, leading

to a fierce competitive playing field as we move into 2023.

The Top Global Ecommerce Players

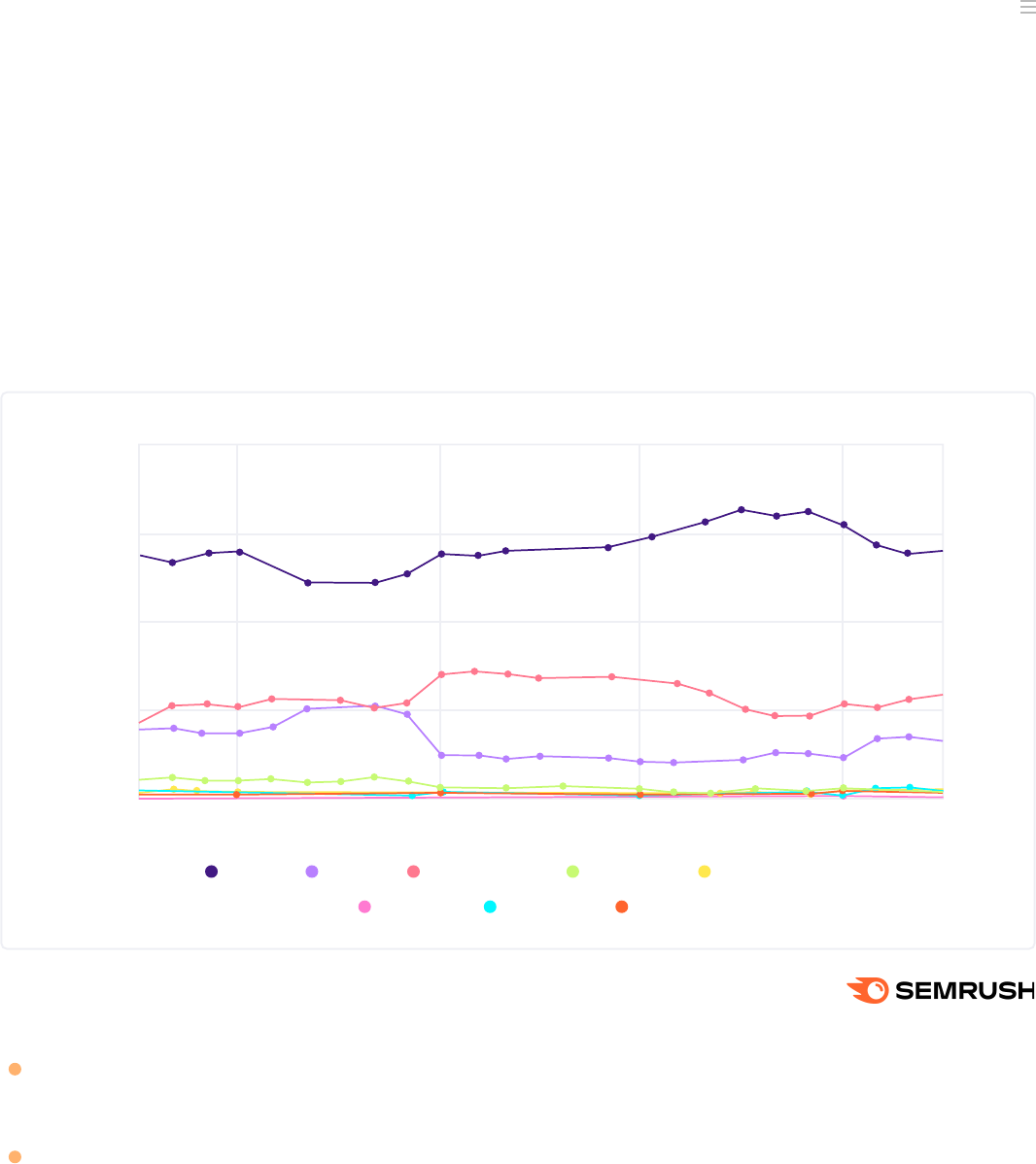

In the global ecommerce market, the dominance of US-based businesses is still evident,

with amazon.com, ebay.com, and walmart.com among the top players. However, the industry is

constantly evolving as smaller players emerge as serious competitors.

By analyzing the traffic data for 2022 and 2023, we can identify some significant trends shaping

the global ecommerce landscape.

10

The Future of Ecommerce Is Now

While two of the three top domains in terms of traffic were U.S. companies–amazon.com

and walmart.com–the largest year-over-year growth was seen by China-based aliexpress.com

with a huge 44% increase.

The leaders in terms of traffic growth were both based in Asian markets. India-based e-tailer flipkart.

com saw a significant 90% increase in traffic. The winner, however, was lazada.com.ph, which saw

growth near 200% driven by the Philippine market.

Amazon.com dominated the list, winning spots in the US, German, and UK markets, though growth

was not equal across the board. While German and UK markets saw growth of 16% and 20%,

respectively, year-over-year growth in the U.S. was less than 1%.

For 2023, all of the companies in the top 10 saw positive growth, with 80% showing double- or triple-

digit increases. This appears to be a major shift toward growth after slim gains in 2022.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Domain

amazon.com

aliexpress.com

walmart.com

ebay.com

etsy.com

amazon.de

amazon.co.uk

rakuten.co.jp

flipkart.com

lazada.com.ph

Average Monthly

Values 2023

2.84 B

845 M

748.1 M

699.9 M

496 M

490.1 M

389.9M

382.7M

291.9 M

287.1 M

YoY Change

(2022-2021)

4.75%

9.22%

5.74%

-17.30%

12.20%

5.63%

3.34%

-8.33%

3.08%

-18.04%

YoY Change

(2023-2022)

0.94%

43.87%

35.82%

15.93%

9.93%

16.22%

20.22%

16.52%

89.86%

197.87%

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Top 10 Ecommerce Industry Players

Global 2022-2023

11

The Future of Ecommerce Is Now

When looking at individual players on a global scale, similar trends emerge.

While U.S. and European brands saw growth, the list leaders in terms of traffic growth

were focused on Asian markets. Overall, the strong increases among

the top players suggest 2023 could turn out to be a much better year than

2022 for the industry.

The Top U.S. Ecommerce Players

Although many of the top U.S. ecommerce players also appear on the global list, their year-

over-year growth rates have been less impressive. This trend mirrors the overall decline in U.S.

ecommerce traffic, which has dropped by 19% from 2022 to 2023.

While the data showed only the slightest of increases in traffic so far in 2023, some potential

winners and losers have begun to emerge.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Domain

amazon.com

walmart.com

ebay.com

etsy.com

homedepot.com

bestbuy.com

target.com

lowes.com

aliexpress.com

cvs.com

Average Monthly

Values 2023

1.92 B

712.38 M

478.02 M

238.6 M

153.92 M

137.43 M

136.17 M

104.99 M

89.28 M

77.74 M

YoY Change

(2022-2021)

5.88%

6.37%

-17.57%

6.47%

-13.66%

-17.90%

-16.62%

-17.25%

29.56%

-16.61%

YoY Change

(2023-2022)

-8.75%

39.09%

12.91%

-10.34%

-10.23%

-9.92%

-18.06%

-2.98%

33.10%

-15.43%

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Top 10 Ecommerce Industry Players

U.S. 2022-2023

12

The Future of Ecommerce Is Now

Grow your market share

with Semrush ecommerce apps

TRY NOW

Amazon.com, with almost 2B total traffic in the US, declined by 9% in 2023, while walmart.com saw

nearly 40% in gains. Walmart.com’s ecommerce strategy has shown success, as both companies had

similar growth rates in 2022.

Aliexpress.com has seen year-over-year gains of 33% so far in 2023, marking the brand as one

of the leaders in the US. Though monthly traffic remains well below that of list leaders, continued

growth at the rate could boost the brand toward the top of the list in years to come.

Target.com (-18%), homedepot.com (-10%), and cvs.com (-15%), all saw double-digit declines

in 2022 and 2023. These brick-and-mortar brands may be losing traction as the world stabilizes

after COVID.

The U.S. ecommerce market has seen a decrease in traffic, impacting the growth rates

of top players. walmart.com and aliexpress.com appear to have a strong footing for 2023,

while brick-and-mortar focused businesses such as target.com, homedepot.com,

and cvs.com have struggled. This highlights the challenge of increased competition

from brands focusing on ecommerce.

13

The Future of Ecommerce Is Now

Domain

amazon.com

walmart.com

ebay.com

etsy.com

homedepot.com

bestbuy.com

target.com

lowes.com

aliexpress.com

cvs.com

Estimated Ad Spending,

U.S. May 2022-March 2023

$1.7 B

$414.6 M

$112.5 M

$88.5 M

$166.3 M

$33.3 M

$603.9 M

$17.2 M

$322 K

$41.3 M

Source: AdClarity – Advertising Intelligence

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ad Spending for Top

U.S. Ecommerce Players

Estimated Ad Spending Among Top Ecommerce Players

U.S. 2022-2023

When considering the top 10 players in terms of ad spending in 2022-2023, the list looks slightly

different. In total, the industry leaders spent 3.5B in advertising, with a massive range of spends

anywhere from 41.3M to 1.7B.

Looking at the individual players with Data from Semrush’s AdClarity App →, some interesting

metrics appear.

14

The Future of Ecommerce Is Now

Amazon.com is the dominant player with an estimated ad spend of $1.7B, which is more than four

times the second-ranked website, walmart.com.

Aliexpress.com spent the least at only $322K for the year, which is more than 5000 times lower

than the ad spend of amazon.com. Their progress in terms of traffic growth, however, has been

astounding.

Ebay.com, which takes the third spot in terms of traffic, spent less than homedepot.com ($166M)

and target.com ($604M), showing that ad spend does not beat brand recognition

when it comes to traffic.

As may be expected, amazon.com led the list with a huge ad spend to match their massive traffic.

But looking beyond the behemoth, some other insights emerge.

Primarily, the data also suggests that brand recognition and other factors may play a more

important role than ad spend alone in driving traffic, as evidenced by ebay.com’s lower ad spend

compared to homedepot.com and target.com, despite being ranked higher in terms of traffic.

15

The Future of Ecommerce Is Now

Amazon.com is a dominant player in the e-commerce market across multiple regions,

including North America, Europe, and Asia.

Regional players are also gaining significant traffic counts in their respective markets,

such as trendyol.com in MEA and mercadolivre.com.br in LATAM. The trend in regions with smaller

and developing economies suggests that regional players still hold significant

sway in their respective markets, and amazon.com may see its overall market share decline in these

regions as they continue to grow.

The top e-commerce websites in each region tend to have significantly higher traffic counts

compared to their closest competitors. While it isn’t true across the board, this trend suggests

there’s a significant benefit to holding the top spot.

Top Ecommerce Players by Region

The traffic data from March 2023 to the top domains within each region indicates some

interesting trends both within specific regions and across regions.

North America

amazon.com

walmart.com

ebay.com

Domain

By traffic in March 2023

2,075,585,761

928,669,986

519,317,106

Europe

amazon.de

aliexpress.com

amazon.com

472,629,786

355,241,344

285,725,993

Domain

By traffic in March 2023

Domain

By traffic in March 2023

LATAM (Latin America)

mercadolivre.com.br

amazon.com

amazon.com.br

170,959,307

170,420,873

155,308,916

APAC (Asia-Pacific)

amazon.in

rakuten.co.jp

flipkart.com

563,108,373

345,974,595

321,858,954

Domain

By traffic in March 2023

MEA (Middle East and Africa)

trendyol.com

amazon.com

hepsiburada.com

126,279,017

97,656,763

75,043,805

Domain

By traffic in March 2023

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

16

The Future of Ecommerce Is Now

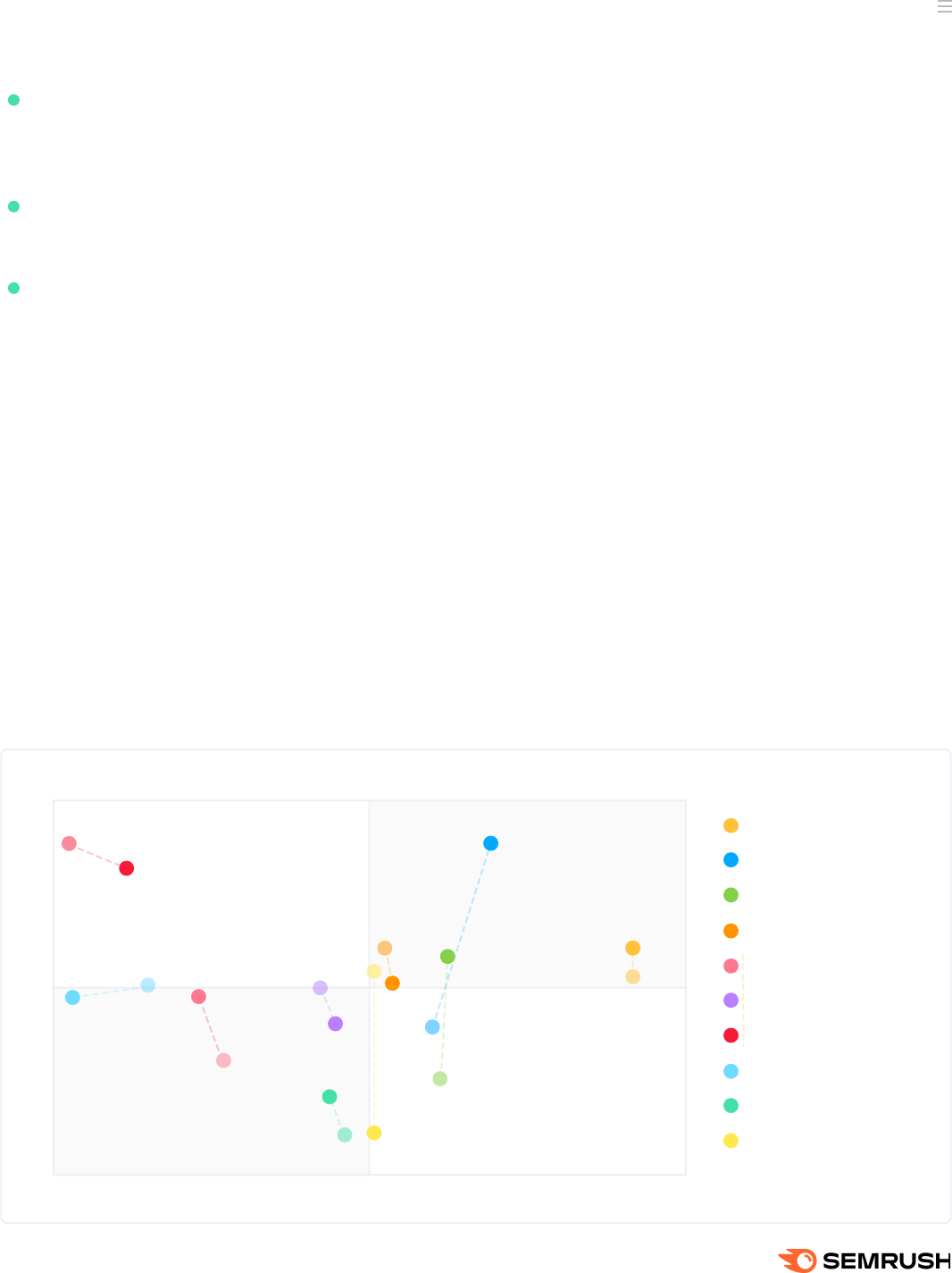

Ecommerce Market Position Dynamics

Visualizing the competitive landscape helps develop an understanding of market dynamics.

We’ve mapped the top 10 players onto a competitive matrix according to their domain traffic

and traffic growth rate comparing growth in January through March of 2022 against

the same period in 2023.

Globally, when comparing January-March of 2022 against the same period in 2023, we see some

clear trends emerge.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Game Changers

Traffic →

Traffic Growth, %→

Niche Players

Leaders

Established Players

amazon.de

amazon.co.uk

lazada.com.ph

rakuten.co.jp

aliexpress.com

flipkart.com

etsy.com

ebay.com

walmart.com

amazon.com

amazon.com

walmar t.com

ebay.com

etsy.com

lazada.com.ph

flipkar t.com

aliexpress.com

rakuten.co.jp

amazon.co.uk

amazon.de

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Top Ecommerce Industry Players’ Market Position Dynamics

Global 2022-2023

17

The Future of Ecommerce Is Now

Flipkart.com and lazada.com.ph are both Game Changers. Flipkart.com saw significant

traffic growth in 2023 and both players are expected to have a big impact on the growing

Asian market.

Walmart.com made the biggest jump from niche player to market leader globally, with aliexpress.

com maintaining its leader position with slightly slower growth in 2023.

While amazon.com continues to be a global leader, their German and UK domains saw a decrease

in traffic growth. Overall, the online retailer has maintained its dominance,

though threat from other players remains a reality.

The U.S. Ecommerce

Competitive Landscape

Looking specifically at the ecommerce landscape in the US, a slightly different set of players

dominate the market. While some of the major market leaders remain in place, some important

distinctions emerge, especially in the Game Changers and Niche Players categories.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Game Changers

Traffic →

Traffic Growth, %→

Niche Players

Leaders

Established Players

homedepot.com

target.com

cvs.com

aliexpress.com

bestbuy.com

lowes.com

etsy.com

ebay.com

walmart.com

amazon.com

amazon.com

walmar t.com

ebay.com

etsy.com

lowes.com

bestbuy.com

aliexpress.com

cvs.com

target.com

homedepot.com

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Top Ecommerce Industry Players’ Market Position Dynamics

U.S. 2022-2023

18

The Future of Ecommerce Is Now

The leaders category includes etsy.com, ebay.com, walmart.com, and amazon.com for the highest

traffic volumes. walmart.com is the clear leader for increases in traffic percentages compared

to the previous period, with ebay.com not too far behind.

In the Game Changers category, Chona-based aliexpress.com poses the biggest threat

to market leaders.

Retailers with a dual focus on brick-and-mortar shopping experiences didn’t fare as well as online

only retailers. Cvs.com, lowes.com, bestbuy.com, and target.com all fell into the Niche Players

category, with cvs.com and bestbuy.com seeing negative traffic growth rates.

Comparing global and U.S. ecommerce landscapes reveals some trends. U.S. leaders are also

global leaders due to the country’s significant share of the global ecommerce market. However,

Game Changers like flipkart.com and lazada.com.ph are more influential globally, while aliexpress.

com makes the biggest impact in the US. This highlights the need for ecommerce businesses

to consider regional differences when developing strategies.

19

The Future of Ecommerce Is Now

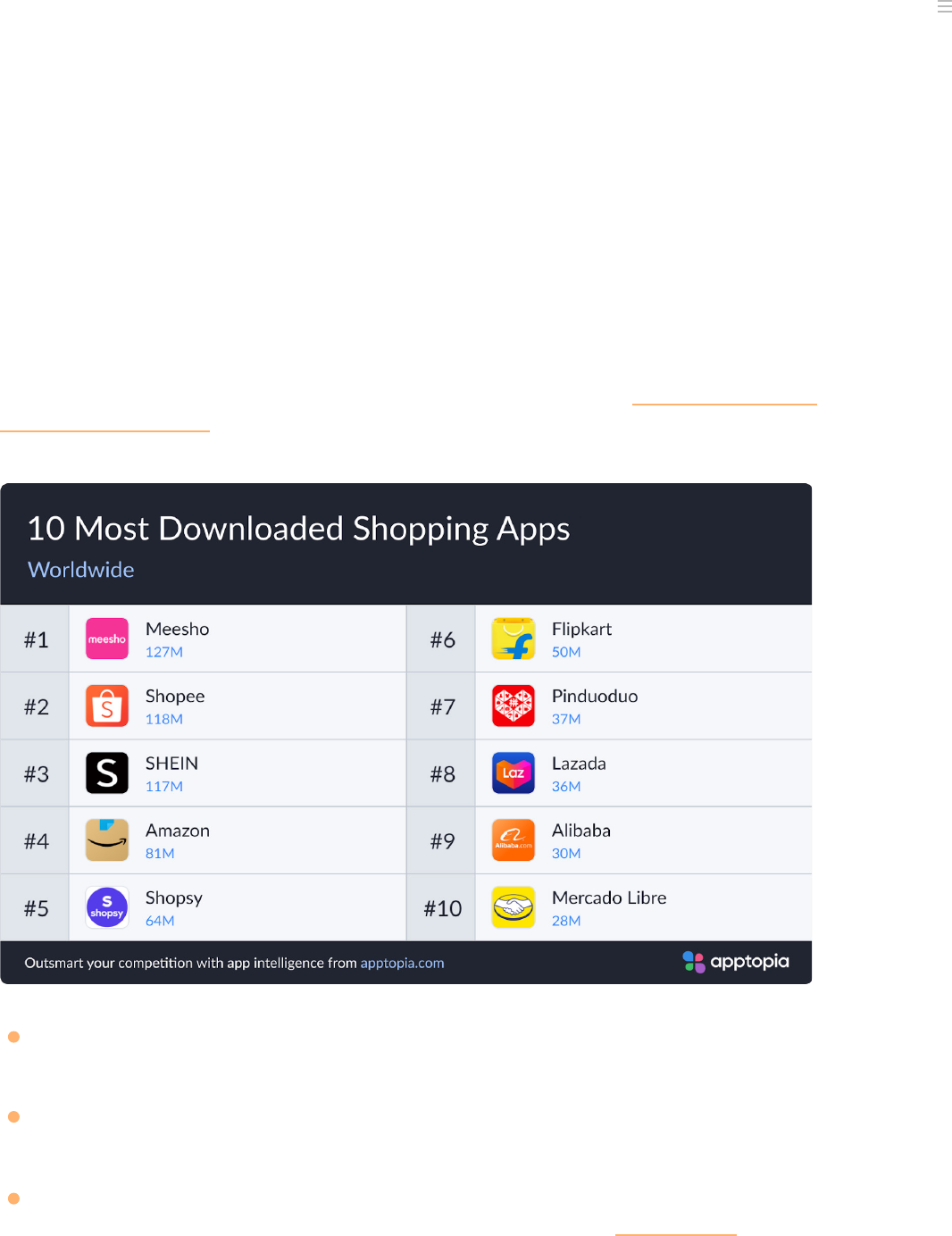

Apps Data

Mobile data is becoming increasingly important in the ecommerce industry, as mobile

usage is on the rise again in 2023 after a slight decline in the previous year. In particular,

mobile apps are now the primary channel for consumers to shop online, highlighting

the significance of app data for businesses in this space.

The top three apps in terms of global downloads were Meshoo, Shopee, and Shein. All of these apps

are owned by companies based in China and primarily serve users throughout markets across Asia.

While Amazon tops the charts in terms of traffic volume, it came in fourth place in terms

of downloads. Likewise, Flipkart, Lazada, and Mercado Libre came in on the lower half of the list.

While brands like Walmart and Aliexpress remain chart toppers when we consider traffic volume,

they don’t even make the list of top 10 shopping apps in terms of downloads →.

The Top 10 Ecommerce

Mobile Apps Worldwide

The list of top shopping apps showed some familiar trends. That said, the list also included

some unexpected names. Here’s a look at the Top 10 as determined by research conducted

by Apptopia in 2022 →.

21

The Future of Ecommerce Is Now

A mobile app strategy is an important component of any ecommerce business strategy.

As shoppers depend more and more on their phones to meet their shopping needs,

brands without a strong mobile app will undoubtedly lose out.

When looking at shopping apps as a category compared with other kinds of apps, there

are some important trends to note, as shown in this data from Semrush App Center

partner, Mobile App Insights →.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Mobile App Insights

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

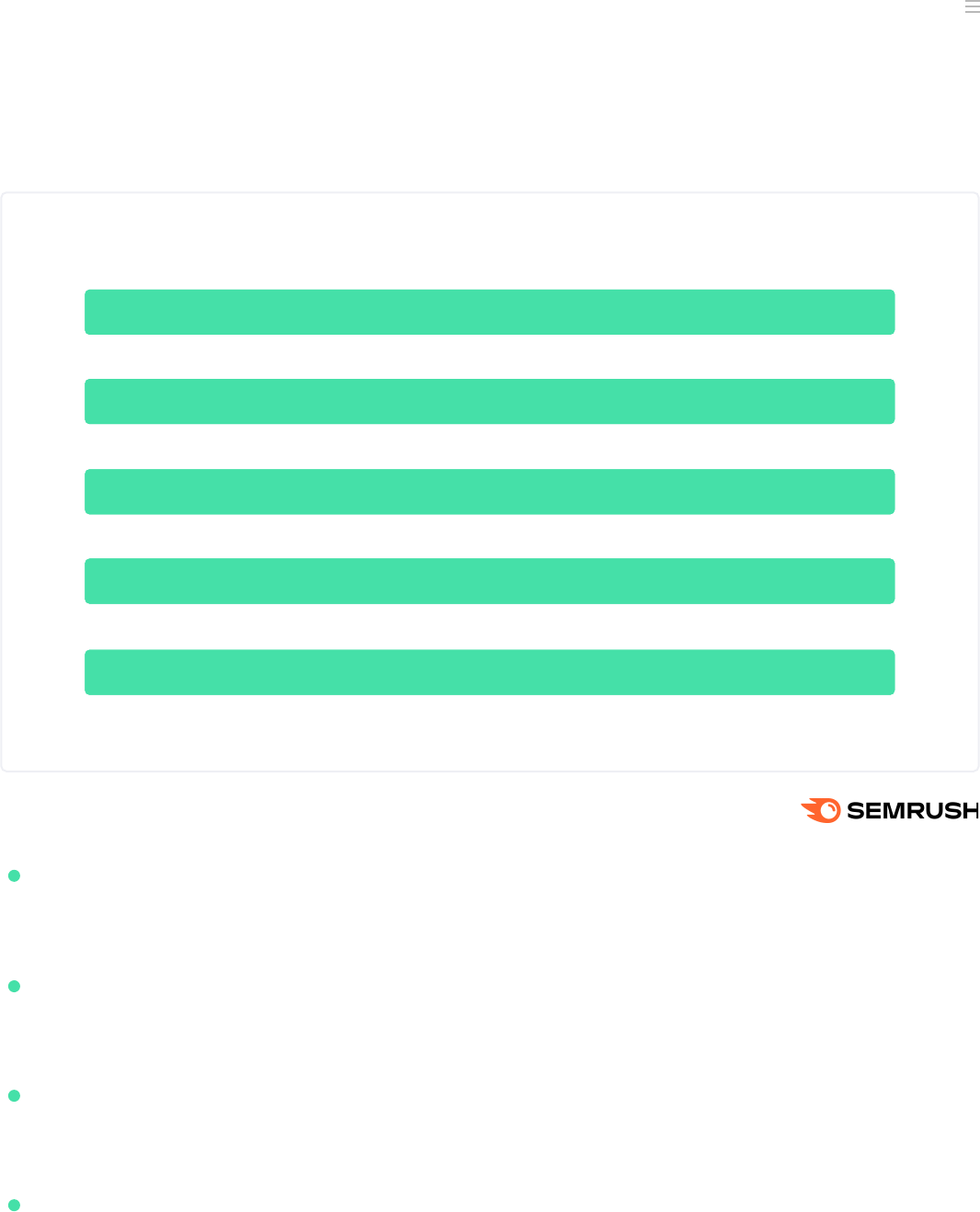

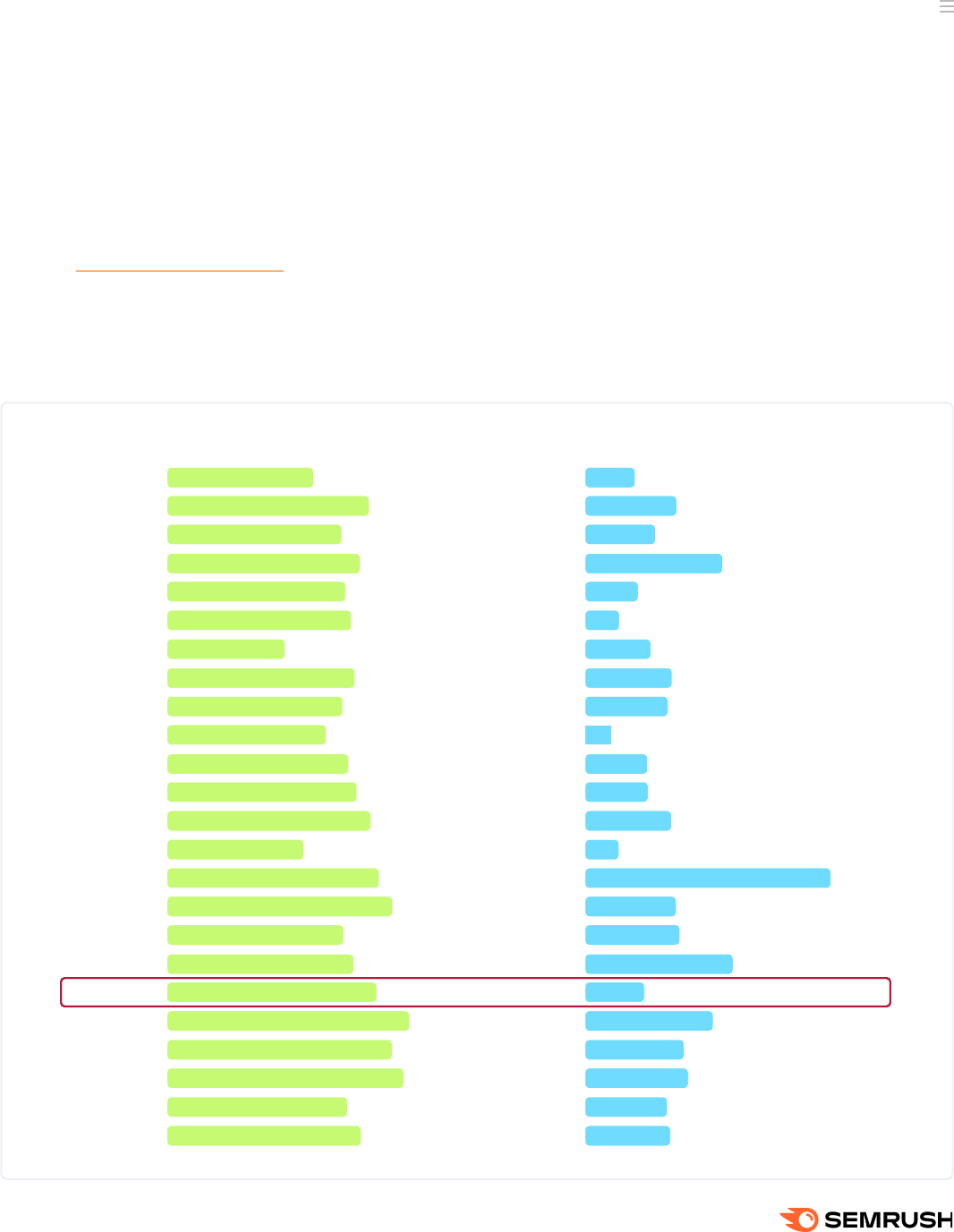

Conversion and Tap Through Rates by App Category

Global 2023

Conversion Rates

Books

Business

Education

Entartainment

Finance

Food and drink

Games

Graphics & Design

Health & Fitness

Lifestyle

Medical

Music

Navigation

News

Newsstand

Photo & video

Productivity

Reference

Shopping

Social Networking

Sports

Travel

Utilities

Weather

46.47%

64.37%

55.68%

61.44%

56.88%

58.72%

37.52%

59.69%

56.09%

50.52%

57.78%

60.25%

64.91%

43.39%

67.42%

71.81%

56.21%

59.57%

66.68%

77.30%

71.78%

75.28%

57.63%

61.57%

Tap Through Rates

Books

Business

Education

Entartainment

Finance

Food and drink

Games

Graphics & Design

Health & Fitness

Lifestyle

Medical

Music

Navigation

News

Newsstand

Photo & video

Productivity

Reference

Shopping

Social Networking

Sports

Travel

Utilities

Weather

4.12%

7.62%

5.86%

11.55%

4.37%

2.77%

5.42%

7.25%

6.87%

2.12%

5.16%

5.20%

7.21%

2.72%

20.73%

7.63%

7.86%

12.40%

4.90%

10.76%

8.25%

8.59%

6.84%

7.09%

22

The Future of Ecommerce Is Now

In the shopping category, Costs Per Acquisition (CPA) and Cost Per Tap (CPT) rates tend

to be slightly higher than rates for apps in other categories

Compared to other categories, shopping apps had a slightly higher conversion rate at 67%,

and a lower tap through rate just below 5%.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: SearchAds.com

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

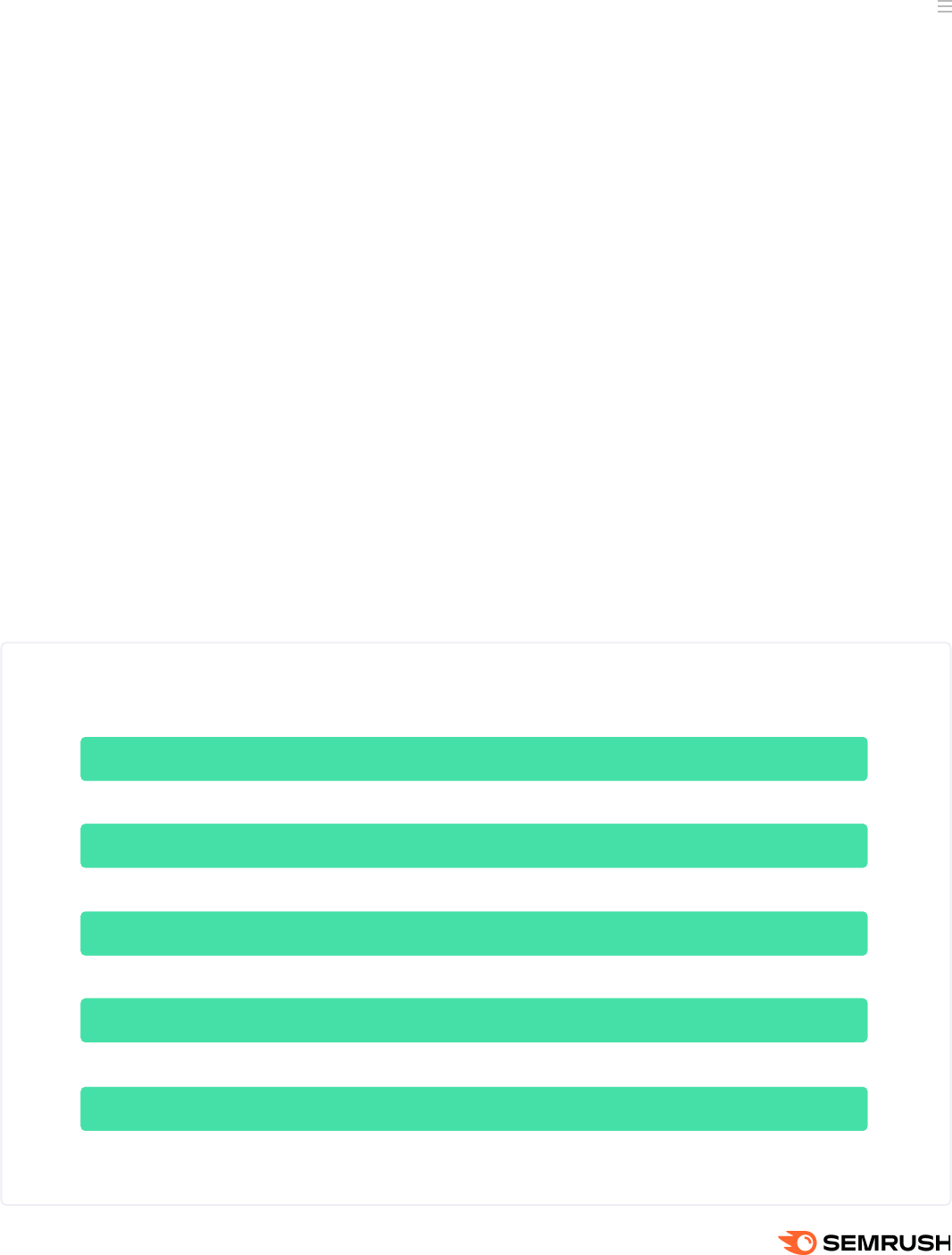

Apple Search Ads Benchmark Report by App Category

Global 2023

Category

Books

Business

Education

Entartainment

Finance

Food and drink

Games

Graphics & Design

Health & Fitness

Lifestyle

Medical

Music

Navigation

News

Newsstand

Photo & video

Productivity

Reference

Shopping

Social Networking

Sports

Travel

Utilities

Weather

CPA

$ 3.11

$ 0.85

$ 2.82

$ 0.78

$ 2.62

$ 1.32

$ 4.17

$ 2.38

$ 1.86

$ 1.99

$ 2.67

$ 1.03

$ 0.94

$ 4.32

$ 3.63

$ 0.59

$ 1.68

$ 1.81

$ 2.92

$ 0.49

$ 8.74

$ 1.44

$ 1.95

$ 1.31

CPT

$ 1.45

$ 0.54

$ 1.57

$ 0.48

$ 1.49

$ 0.77

$ 1.57

$ 1.42

$ 1.04

$ 1.01

$ 1.54

$ 0.62

$ 0.61

$ 1.88

$ 2.45

$ 0.42

$ 0.94

$ 1.08

$ 1.95

$ 0.38

$ 6.28

$ 1.09

$ 1.13

$ 0.80

CR

46.47%

64.37%

55.68%

61.44%

56.88%

58.72%

37.52%

59.69%

56.09%

50.52%

57.78%

60.25%

64.91%

43.39%

67.42%

71.81%

56.21%

59.57%

66.68%

77.30%

71.78%

75.28%

57.63%

61.57%

CR

4.12%

7.62%

5.86%

11.55%

4.37%

2.77%

5.42%

7.25%

6.87%

2.12%

5.16%

5.20%

7.21%

2.72%

20.73%

7.63%

7.86%

12.40%

4.90%

10.76%

8.25%

8.59%

6.84%

7.09%

March 01, 2023 - March 31, 2023

Cost Per Acquisition (CPA) Cost Per Tap (CPT) Conversion Rate (CR) Tap Throuh Rate (TTR)

$ 2.18 $ 1.16 53.23% 5.26%

23

The Future of Ecommerce Is Now

Ecommerce

Shoppers’

User

Behavior

The pandemic significantly changed consumer behavior and trends seen across

marketing channels, but as restrictions ease and anxieties lessen, how have trends

shifted? Economic stimulus, rising interest rates, and tightened business budgets all

play a role in changing consumer interactions with ecommerce in 2022 and 2023.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Desktop and Mobile Traffic Share Ecommerce Trend

Global 2019-2023

20 B

15 B

10 B

5 B

0

Jan’19 Jan’20

Jan’21 Jan’22 March’23

Mobile Desktop

Ecommerce Industry

Traffic Trends by Device (Global)

2020 showed an almost even device penetration, with desktop usage coming close to 50%. Just

as the world was slowly rolling back on some pandemic restrictions, the gap widened once again.

By the start of 2022, mobile traffic absolutely dominated the ecommerce industry, with more than

70% of online shoppers surfing ecommerce sites from their phones. This rise of mobile started

in early 2021 when we saw unprecedented growth in mobile usage compared to desktop—the last

time we saw a similar 70%+ figure for mobile was at the end of 2019.

25

The Future of Ecommerce Is Now

In the summer of 2022, however, we witnessed a significant drop in mobile traffic.

This decrease reflects the overall decrease in traffic to the ecommerce market seen

in the middle of 2022, likely due to growing concerns about an oncoming recession

and decreasing purchasing power → among consumers as pandemic stimulus ran dry.

By the end of the year, however, mobile traffic had risen to a level similar to those seen

in early 2022. And after a slight decline after the start of the year, they seem to be

on the rise again entering the spring of 2023.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ecommerce Traffic Share by Channel Trend

Global 2019-2023

80%

60%

40%

20%

0%

Jul’21 Jan’22 Jul’22 Jan’23

Direct Referral Search Organic Search Paid Social Organic

Social Paid Display Ads Email

Ecommerce Industry Traffic Trends Global

While the early years of the pandemic brought unprecedented growth to the ecommerce

industry in terms of traffic, the distribution among channels showed only slight growth

in the Direct channel, and slight declines in the Search and Referral channels. Starting in early

2021, however, distribution of traffic among major channels underwent some volatility that has

continued through 2022 and into 2023.

26

The Future of Ecommerce Is Now

Direct–After a spike in share in 2021, levels have fluctuated through 2022, with a recent downturn

at the start of 2023. Regardless of the volatility, Direct accounts for upwards of 53% of all traffic

in the ecommerce industry at the start of 2023, meaning brand awareness is still one of the most

important components of any marketing strategy.

Organic Search–The second most popular channel, Organic Search witnessed a high in early 2022

near 35%. The channel saw declines through 2022, though 2023 has brought an uptick in traffic

through the channel to closer to 30%.

Referral–With a boost through 2021 to a high near 15% in October, Referral traffic saw a decline

at the start of 2022, and flatlined through the year. 2023 brought initial signs of an increase

with rates around 12%, though in the first quarter, Referral traffic seems to be falling once again.

Paid Search–Accounting for about 2% of ecommerce traffic through 2021, the Paid Search channel

saw a decline at the start of 2022. It has remained steadily below 2% through the start of 2023.

Organic Social–Through 2022, Organic Social accounted for less than 2% of the traffic

to the ecommerce market. At the start of 2023, however, the channel overtook paid search

rising above 2% while Paid Search continued to drop.

Paid Social–Remaining relatively flat through 2022 and 2023, Paid Social contributed less than

1% of traffic to the ecommerce industry. After a slight increase just after the start of 2023,

the channel flatlined once again.

Email–Through 2022, Email traffic lingered below 1% of traffic to the ecommerce industry.

The start of 2023, however, brought a boost for the channel. Since January, the channel has

remained above 1.2%.

Display Ads–Hanging around 1.5% through 2022, traffic from Display Ads has risen above

2% at the start of 2023.

27

The Future of Ecommerce Is Now

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ecommerce Traffic Share by Channel Trend

U.S. 2019-2023

In the U.S. 57% is direct (compared to 53% globally), meaning brand awareness is even more

important when focusing on U.S. ecommerce markets.

Organic Search accounts for 23% of ecommerce traffic in the US, while Referral accounts for 13%.

These figures are slightly different from the global numbers, which show Organic Search accounting

for 28% and Referral accounting for 11% on average.

Ecommerce Industry Traffic Trends U.S.

U.S. trends in the Ecommerce industry closely follow global trends due to the country's large

share of total traffic. However, there are some significant differences that businesses should

consider when targeting U.S. markets.

80%

60%

40%

20%

0%

Jul’21 Jan’22 Jul’22 Jan’23

Direct Referral Search Organic Search Paid Social Organic

Social Paid Display Ads Email

28

The Future of Ecommerce Is Now

While overall, social media plays a small role in terms of overall traffic distribution, it can’t

be ignored. Alongside the traffic it brings to ecommerce domains, it serves many other

purposes, including brand awareness, customer engagement, customer acquisition,

and customer retention.

When looking at ecommerce specifically in the realm of social media, some recent

trends have emerged that those in the ecommerce industry can’t ignore. By 2025,

the market for products sold directly through social media could reach $1.4 trillion →

in total. This growth is being driven by a combination of factors, including the increasing

popularity of social media platforms, the rise of influencer marketing, and the growth

of mobile commerce.

The Rise of TikTok

While Youtube and Facebook remain the behemoths in the ecommerce industry, Tiktok is

the next social media platform ecommerce marketers are looking to conquer. Having

surpassed 1B → users, the video based platform is changing the social media game.

When looking at audience data from top ecommerce players, we’ve seen the audience

using TikTok more than double.

Social Media

29

The Future of Ecommerce Is Now

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Social Media

YouTube

Facebook

Reddit

Twitter

Instagram

LinkedIn

Pinterest

TikTok

amazon.com

562.6M

365.1M

275.9M

266M

231.3M

117.5M

99.7M

92.1M

74.92%

48.62%

36.73%

35.43%

30.81%

15.65%

13.27%

12.27%

walmart.com

140.5M

97.3M

88M

74.6M

62.1M

26.8M

24.4M

19.8M

72.27%

50.05%

45.27%

38.38%

31.95%

13.79%

12.53%

10.16%

ebay.com

183.6M

130.2M

95.7M

88M

83M

36.2M

33.4M

33M

82.14%

58.26%

42.84%

39.38%

37.14%

16.17%

14.94%

14.76%

etsy.com

144.4M

104.2M

83M

75.9M

76.1M

34.5M

36.2M

30.7M

80.01%

57.77%

45.98%

42.07%

42.18%

19.1%

20.08%

17.03%

aliexpress.com

192.1M

119.9M

56.1M

67.5M

72.2M

26.5M

24.3M

30.4M

76.03%

47.46%

22.22%

26.71%

28.56%

10.5%

9.62%

12.03%

All devices March 2022

Social Media

YouTube

Facebook

Reddit

Twitter

Instagram

TikTok

LinkedIn

Pinterest

Telegram

amazon.com

728.8M

495.8M

345.4M

341.6M

303.1M

215.7M

140.1M

105.7M

53.6M

75.31%

51.23%

35.7%

35.3%

31.32%

22.29%

14.47%

10.92%

5.53%

walmart.com

186.7M

126.6M

125.2M

101.9M

86.4M

62.5M

30.2M

26.5M

5.7M

63.63%

43.14%

42.65%

34.72%

29.45%

21.31%

10.28%

9.03%

1.93%

ebay.com

235.8M

168.7M

115.7M

107.9M

110M

73.8M

44.4M

37.6M

19M

81.94%

58.61%

40.2%

37.51%

38.22%

25.64%

15.42%

13.07%

6.61%

etsy.com

198M

148.6M

106.7M

99.9M

105.5M

70.1M

43.9M

42.7M

12.7M

79.94%

59.98%

43.07%

40.31%

42.6%

28.3%

17.71%

17.23%

5.13%

aliexpress.com

347.3M

212M

88.9M

125.6M

133M

98.1M

43.4M

38.8M

45.1M

76.11%

46.47%

19.5%

27.53%

29.16%

21.5%

9.51%

8.51%

9.88%

All devices March 2023

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ecommerce Audience Social Media Preferences

Global 2022-2023

30

The Future of Ecommerce Is Now

Get more data with Semrush

ecommerce apps

TRY NOW

What is it about TikTok that makes it such a powerful resource for those in

the ecommerce industry?

Along with a growing user base (35% of whom have made a purchase on the platform →)

and hard hitting influencers, TikTok provides the tools on the platform to effectively

reach audiences.

Companies and creators can build their own TikTok storefronts, and sellers can create

web stores quickly through simple integrations with ecommerce platforms

Hashtag and keyword options allow sellers to improve visibility to high value audiences

Promoting products on TikTok can help businesses reach a younger audience, with 63%

of Gen Z using the app daily

As user numbers and ecommerce functionality continues to grow on the platform, those

in the ecommerce industry are sure to miss out if they ignore this rising social media star.

31

The Future of Ecommerce Is Now

Artificial Intelligence,

Augmented Reality,

and the Future

of Ecommerce

As the use of artificial intelligence (AI) and augmented reality (AR) continues to grow

in popularity, the impact on ecommerce → is becoming increasingly apparent.

In particular, the emergence of sophisticated AI chatbots → is changing the way

customers interact with online retailers.

ChatGPT, a leading language based AI, has gained significant interest recently. The

sheer growth in search trends for the AI reflects the massive impact it’s having across

the globe. Keyword searches went from 10 monthly searches in November 2022 to 101M

monthly searches by March 2023.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

125 M

100 M

75 M

50 M

25 M

0

September 2022 November 2022

January 2023

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

ChatGPT Search Volume Trend

Global Q3 2022- Q1 2023

AI and AR are significantly impacting the ecommerce market in 2023 with rapid

advancements in language models, computer vision models, and machine learning.

These technologies are providing personalized customer experiences, automated

customer service, improved ad targeting, and enhanced operations.

33

The Future of Ecommerce Is Now

Personalized Experiences

AI can help businesses analyze customer data to provide personalized product

recommendations that are tailored to each individual shopper's preferences, optimize

pricing for shifts in the market, and customize customer experiences with their brand.

For example, Netflix's recommendations engine (NRE) → uses AI algorithms to filter

content based on each user's profile, analyzing data from each customer visit and click

to create hyper-personalized recommendations.

Improved Operations

From supply chain management to inventory adjustments, AI and AR technologies allow

ecommerce businesses to stay ahead of challenges and make sure they meet their

customers needs without burning out employees and wasting resources in the process.

Brands like Zara → and IKEA → use AR to allow customers to try on beauty products

and view furniture inside their homes. In doing so, they can limit their returns which

saves resources for their companies and prevents good products from entering

the wastestream.

Customer Service

By using Natural Language Processing (NLP) models, AI can understand

and interpret customer queries, provide relevant responses, and even make product

recommendations. Predictive analytics can also be used to analyze customer data

and anticipate future needs, enabling businesses to tailor their marketing strategies

and product offerings accordingly. The result is an improved customer experience

and increased sales.

For example, Sephora's partnership with Modiface → allows customers to sample

makeup in AR before making a purchase and their chatbot can provide personalized

product recommendations, makeup tips, and tutorials. The chatbot can also help

customers find nearby stores, book appointments, and track their rewards points.

34

The Future of Ecommerce Is Now

Most Wanted

Products and

Calls-to-action

For any business looking to thrive in the ecommerce space, knowing what consumers

want should be top of mind. Even if top products don’t fall within your particular market

niche, understanding customer desires and how calls-to-action work can influence

decisions when it comes to your strategy.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

walmart.com

Product Monthly Traffic

TUMERICA, REPAIR

SERUM 2 OZ

1,552,821

OXY Maximum Strength

Deep Pore Cleansing Pads

590,157

1Pcs Blue Interactive

Cat Toothbrush Pet

561,871

amazon.com

Product Monthly Traffic

The Lord of the Rings:

The Rings of Power

1,557,722

Apple AirPods Pro

(2nd Generation)

743,465

PlayStation 5

Console

377,385

ebay.com

Product Monthly Traffic

AMD Ryzen 7 5800X3D

8-core 16-thread Desktop

140,622

Adidas Ultraboost 22

Shoes Men's

135,658

Adidas Duramo 10

Running Shoes Men's

134,774

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

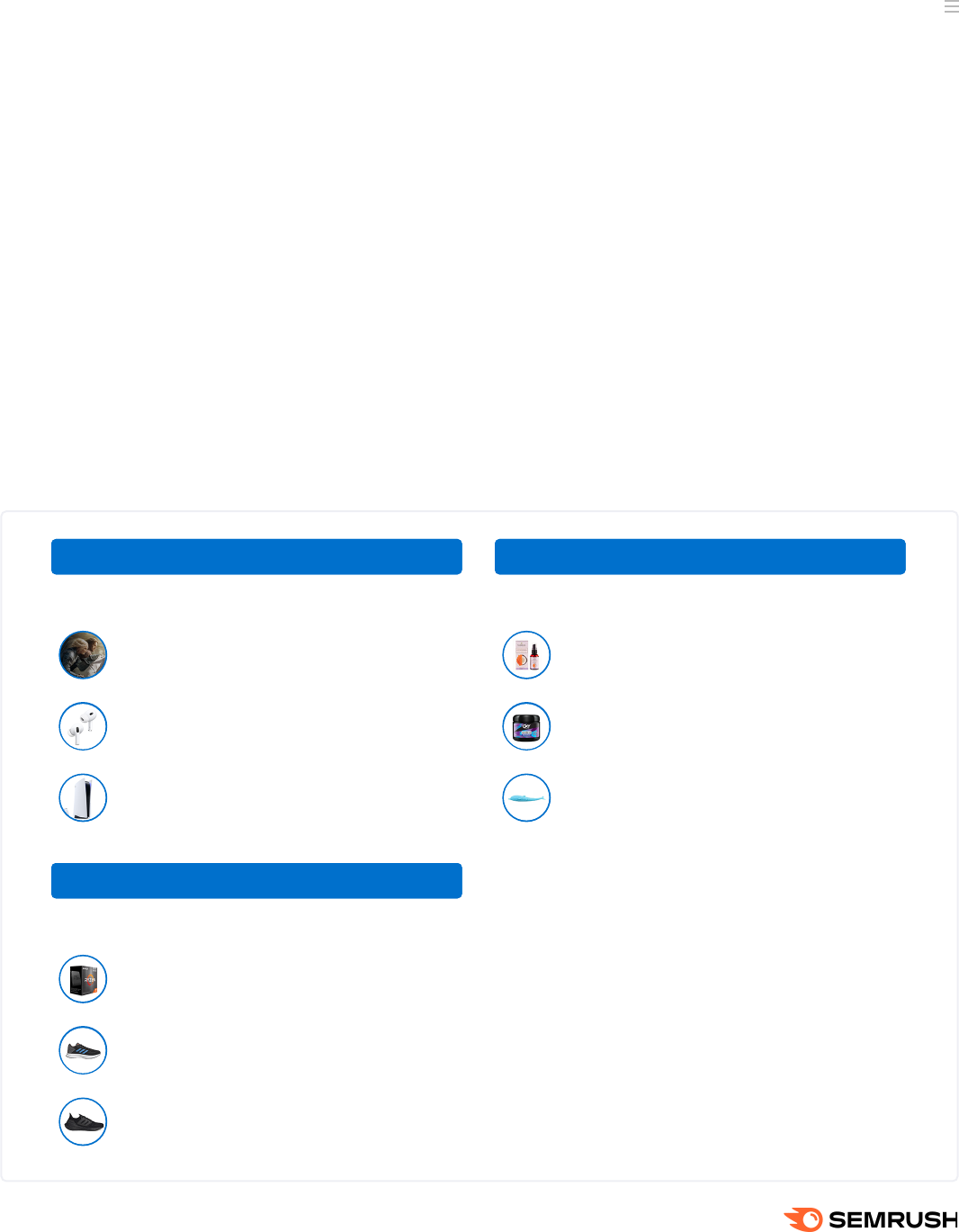

Ecommerce Top Products

U.S. 2022-2023

Ecommerce Industry Top Products

When looking at top products among the top players in the ecommerce industry, some clear

trends come into focus.

36

The Future of Ecommerce Is Now

The top product across all three domains was the Amazon Original series Lord of the Rings: Rings

of Power. Monthly traffic to the product was close to 1.6M.

For each of the top players, the most popular products fall into distinct categories. Amazon.com

featured an original series, walmart.com featured a skincare product, and ebay.com featured

a computer processor.

Electronics were the most popular category of product that appears in the top three for these

retailers. Apple Airpods, Playstation 5, and the AMD Ryzen 7 Desktop processor all appeared across

each of the lists

The popularity of these products and categories offers insight into the purchasing behavior

and interests of online shoppers, and is valuable information for businesses looking to succeed

in this competitive market.

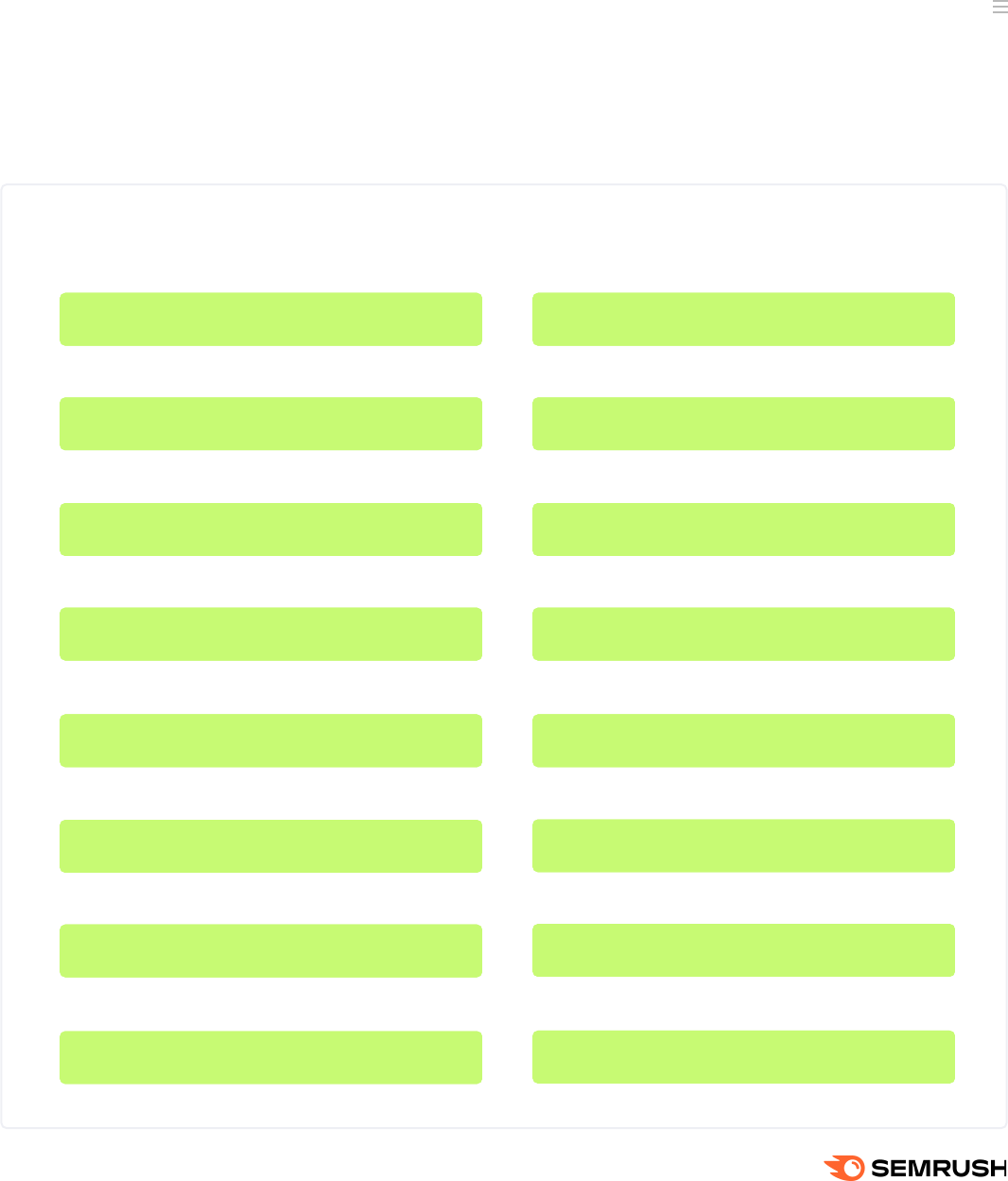

Top Emotional Triggers Featured

in Leading E-Tailers’ Ads

Each marketplace has its own triggers that appeal to consumers and inspire engagement

with the product ad and choose one platform over another.

We’ve analyzed hundreds of digital ads from the top e-tailers in the U.S. and pinpointed the most

popular CTAs within their ad copies. Some useful trends emerge when looking across domains.

37

The Future of Ecommerce Is Now

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

amazon.com

find deals

best sellers

find best

customer reviews

reviews find

ebay.com

huge selection

featured collections

free shipping

buyer protection

protection program

walmart.com

free shipping

low prices

store pickup

free store

millions items

lowes.com

free delivery

buy online

online pickup

pickup store

store get

homedepot.com

free store

store pickup

shop home

free returns

diy projects

bestbuy.com

free shipping

curbside pickup

home install

top deals

store pickup

aliexpress.com

free shipping

buyer protection

great value

safe payment

check deals

etsy.com

one kind

free shipping

everyday supplies

talented creators

ready ship

target.com

free shipping

day delivery

store pick

day store

ship free

cvs.com

online store

store cvs

find relief

relief online

store online

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Ecommerce Top Emotional Triggers

U.S. 2023

38

The Future of Ecommerce Is Now

Free shipping” and “store pickup” are consistently effective trigger words across all domains. Low

prices and finding deals are also popular among ecommerce websites, with many featuring best

sellers and huge selections of products.

For more specialized domains, such as etsy.com and homedepot.com, unique trigger words are

utilized to appeal to specific customer bases. Etsy emphasizes "one-of-a-kind" and "talented

creators", while Home Depot promotes "DIY projects" and "ready to ship" items.

Buyer protection and easy returns are emphasized on aliexpress.com and cvs.com, respectively,

indicating a focus on customer satisfaction and trust.

Overall, the most impactful trigger words vary depending on the domain, but many

ecommerce websites emphasize free shipping and store pickup, low prices, and

finding deals to attract customers.

39

The Future of Ecommerce Is Now

The Giant

on the Market:

Analyzing

Amazon.com

for Insights

In today's competitive ecommerce landscape, amazon.com has emerged

as the undisputed leader. With a staggering 37.8% market share as of 2022, amazon.

com has managed to maintain its stronghold in the market despite stiff competition.

Boasting a global customer base of over 300 million users, amazon.com has effectively

revolutionized the way people shop online.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Amazon.com’s Transaction Funnel From Cart

2022

Average Funnels

When people visit Amazon.com, approximately 67% of them check out a product page.

In around 12% of the visits, users add at least one item to their cart, and in about 8%

of the visits, users complete the purchase after adding items to their cart.

Total

sessions

100%

Sessions with

at least one

product page

66.73%

Sessions with

at least one

add- to-cart

click

11.94%

Sessions with

at least one

transaction from

the cart

8.12%

41

The Future of Ecommerce Is Now

About 13% of sessions result in transactions (either directly or from the cart) after

visiting Product Pages.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Amazon.com’s Product Pages & Transaction Funnel

2022

Total

sessions

100%

Sessions with

at least one

product page

66.73%

Sessions with

at least one

product page

and transaction

13.27%

Estimates place the average ecommerce conversion rate → between 2-3% in 2022. With

this in mind, Amazon.com’s conversion rate is quite impressive. This data is not only useful

for those who want to carve away their piece of the market from amazon.com, but also

for those considering partnering with the behemoth to grow their ecommerce businesses.

“Special Occasions” Funnels

Amazon.com has “special days” that have a big impact on customer behavior.

Here's a look at the metrics for the daily average, benchmarked against

Amazon.com's biggest shopping days.

42

The Future of Ecommerce Is Now

From this data, we can pull out some interesting insights and trends.

On average, the daily average for clicks per session is at 15%.

Prime Day has the highest clicks per session at 19%. This is likely due to customers shopping around

and looking for deals, which can lead to great exposure for sellers.

Black Friday and Cyber Monday had the second highest clicks per session at 16%, and also

the highest cart clicks per transaction. This suggests customers are adding more items to their cart

or are considering multiple options before making a purchase.

Christmas and New Year season showed the largest number of product pages per cart click. This

may suggest that customers are taking more time to consider their purchase decisions and are

conducting more research before making a purchase.

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Stats

clicks per session

cart transactions per session

cart clicks per session

product pages per session

search pages per session

cart clicks per transaction

product pages per transaction

product pages per cart click

search pages per transaction

search pages per cart click

Daily

Average

15.0

0.1

0.2

3.3

2.0

1.7

6.1

4.3

3.2

2.2

Prime

Day

18.8

0.2

0.4

4.6

2.6

1.7

7.4

5.0

3.6

2.4

Prime

Early

Access

Sale

16.0

0.1

0.3

3.9

2.3

2.1

6.7

3.6

3.5

1.8

Black

Friday &

Cyber

Monday

16.3

0.1

0.3

4.2

2.6

2.2

7.2

3.8

3.9

2.1

Christmas

and

New Year

Season

14.8

0.1

0.2

3.7

2.2

1.2

6.9

6.0

3.4

3.0

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Amazon.com “Special Occasions” Funnel

Global 2022

43

The Future of Ecommerce Is Now

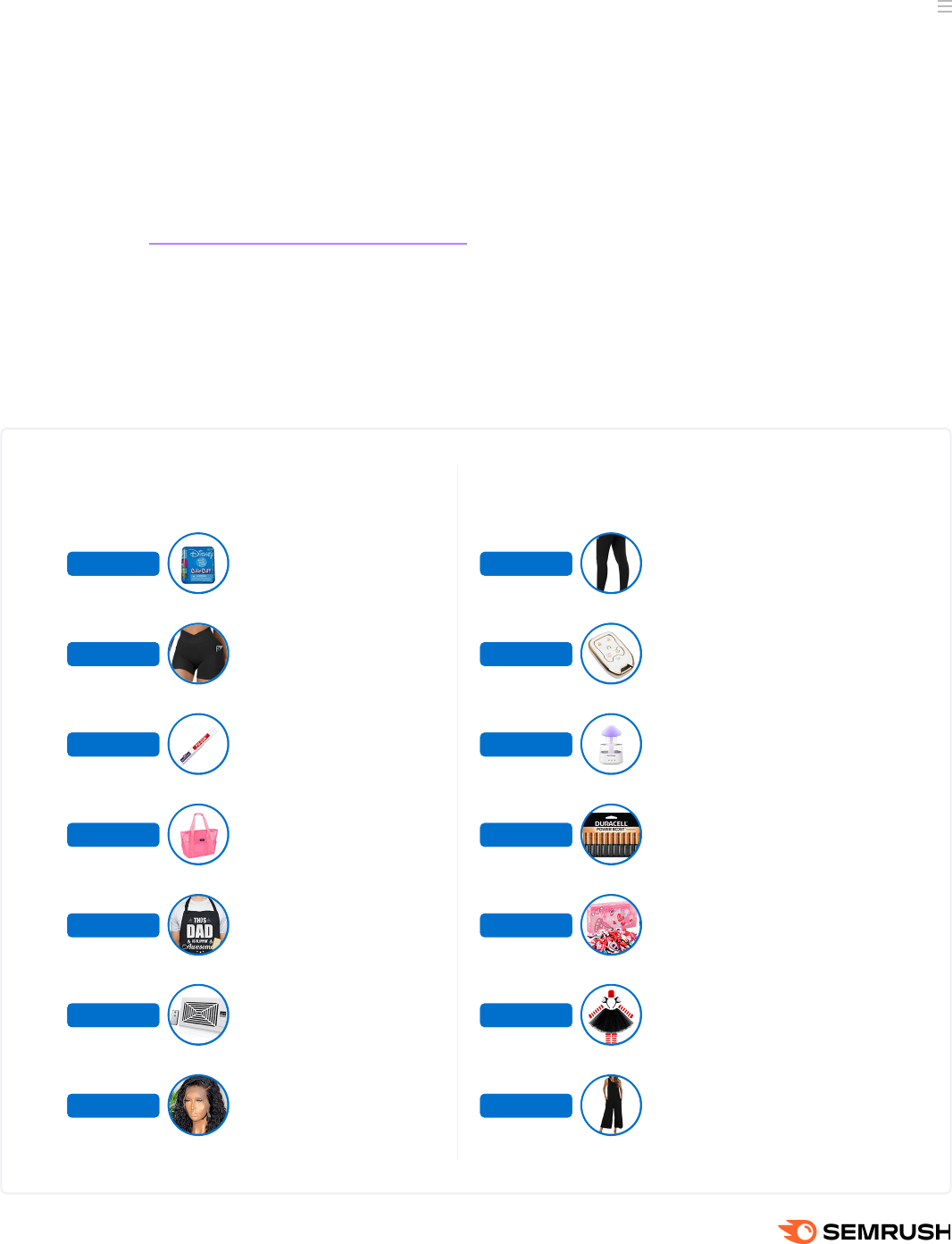

With the help of Keyword Wizard app for Amazon →, we looked at the top 12K most

searched products on amazon.com and compared their month-over-month search

volumes to identify which items saw the highest monthly surges in interest.

Top Trending Products on Amazon.com

in 2022-2023 by Month

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Month Product MoM Growth

disney

cutie cuff

4,052,900%

February ‘22

omkagi biker

shorts

1,372,175%

March ‘22

mohawk

putty stick

1,365,000%

April ‘22

generic

rubber

beach bag

26,091,200%

May ‘22

awesome

fathers day

gifts

143,333%

June ‘22

smart

register vent

5,077,600%

July ‘22

beaushiny

water wave wig

113,603%

August ‘22

Month Product MoM Growth

haynuts

leggings

2,011,275%

September ‘22

white key

fob cover

105,687%

October ‘22

rain cloud

diffuser

187,469%

November ‘22

aa batteries

24 pack+

50,555%

December ‘22

kids valentines

day gifts

14,646%

January ‘23

dr seuss

costumes

for kids

10,944%

February ‘23

air essentials

jumpsuit

800,400%

March ‘23

Source: Keyword Wizard app for Amazon

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Amazon.com’s Top Trending Products

Global 2022-2023

44

The Future of Ecommerce Is Now

Seasonal trends: Many of the trending products on amazon.com were seasonal or holiday-related,

such as a beach bag trending in May and the Valentine’s Day gifts in January.

Virality: Some amazon.com trending products may have gone viral on social media or online

platforms, like Omkagi Biker Shorts in March, possibly due to influencer or celebrity promotion.

Niche products: Many trending products were relatively niche or unique, such as the Mohawk Putty

Stick, the White Key Fob Cover, suggesting a market for specialized or unique products on amazon.

com.

From this data, a few trends and insights appear that may be helpful for ecommerce

businesses as they think about their strategy across the year.

In 2022 and early 2023, we no longer see the masks that became so familiar through

the pandemic. Instead a wide variety of products appear with a few important categories

including electronics, clothing, and office furniture.

Top Products on Amazon.com

in 2022-2023

45

The Future of Ecommerce Is Now

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Source: Semrush .Trends

Mobile traffic

1.000 B

750 B

500 B

250 B

0

May’21 Jul’21 Sep’21 Nov’21 Jan’22

Amazon.com’s Top 30 Product Keywords

Global 2022-2023

Keyword

iphone 13 pro max case

apple watch band

dresses for women 2022

laptop

iphone 13 case

squishmallow

crocs

summer dresses for women 2022

desk

shower curtain

water bottles

lego

airpods

phone 11 case

apple watch

Sum (March 2022 -

February 2023)

19,629,501

18,999,134

18,555,237

16,850,651

16,532,116

16,303,226

16,096,817

15,968,219

14,861,899

14,639,232

14,305,968

13,517,272

13,505,466

13,368,219

13,175,698

Keyword

ps5

iphone

ipad

nintendo switch

air fryer

womens tops

car accessories

dresses

gaming chair

backpack

office chair

headphones

swimsuit women

wedding guest dresses for women

shoe rack

Sum (March 2022 -

February 2023)

13,152,754

12,967,353

12,795,172

12,640,006

12,413,065

12,394,321

12,087,504

12,049,423

11,967,990

11,488,740

11,373,370

11,249,246

11,156,230

11,114,195

10,783,457

46

The Future of Ecommerce Is Now

Get more Amazon insights

with Semrush ecommerce apps

TRY NOW

Apple products are very much in demand, as in 2021–there were 8 products associated

with the brand in the top 30.

The second biggest category of products includes different kinds of clothing. Dresses were most

popular, though swimsuits for women and wedding guest dresses for women were also on the list.

Office accessories were among the biggest winners on the list between 2022-2023.

On the list we see searches for gaming chairs, desks, and office chairs.

Here are a few trends that emerge across the list of the 30 most searched products

on amazon.com.

47

The Future of Ecommerce Is Now

Insight-driven Recommendations

for Shaping Your Future Ecommerce

Marketing Strategy

As the ecommerce industry continues to evolve in the years following the peak of the COVID-19

Pandemic, those in the industry are facing new opportunities and challenges. While the industry

has continued to see strong growth through 2022 and into 2023, those hoping to win the market

will need to keep a close watch on emerging trends so they can keep pace.

From shifting social media landscapes to advancements in AI technology, the ecommerce market

will undoubtedly continue to evolve in the years to come. Here are our main takeaways based

on the data covered in this report.

The Industry Is Poised to Grow

The ecommerce industry has experienced tremendous growth over the past decade and that

growth has continued even after the pandemic. Looking ahead to 2023, there are positive signs

for continued growth, with the potential for another record-breaking year once 2023’s holiday

shopping season is accounted for.

Asian Markets and Ecommerce Businesses Are Thriving

The ecommerce industry's traffic share shifted significantly between 2022 and 2023,

with the U.S. experiencing a 19% decrease and India seeing a substantial increase to become

the second-highest country for web traffic. The global big winners were amazon.com, ebay.com,

and walmart.com, though Asian players flipkart.com and lazada.com.ph saw the most year over

year growth.

A Mobile Strategy Is Still Key in 2023

The rise of mobile usage in ecommerce in 2023 emphasizes the importance of examining

mobile data and shopping apps. Compared to other app categories, shopping apps have

slightly higher CPA and CPT rates, but also a higher conversion rate and lower tap-through rate.

The top 10 ecommerce mobile apps globally in 2022 included familiar names like Amazon,

but also unexpected ones like Meshoo, Shopee, and Shein, which are all based in China

and serve Asian markets.

48

The Future of Ecommerce Is Now

Direct Traffic Is King in Ecommerce, But Don’t Forget Search and Referral

While direct traffic remains king in the ecommerce industry, accounting for 53% of traffic

globally, search and referral have battled for the number two spot over the past few years.

While both channels remain key for any ecommerce marketing strategy, search has emerged

at the start of 2023 as the second highest driver of traffic to ecommerce brands.

TikTok May Be the Future of Ecommerce on Social

TikTok is becoming a powerful resource for those in the ecommerce industry due to its growing

user base, the presence of hard-hitting influencers, and its emerging ecommerce tools.

With a significant proportion of its users having made purchases on the platform, TikTok's

built-in features, such as storefronts and hashtag options, enable businesses and creators

to effectively reach high-value audiences. As a result, companies who ignore TikTok as a platform

to promote their products risk missing out on potential sales, especially from younger

generations of customers.

Artificial Intelligence and Augmented Reality Are Essential

Rapid advancement in the world of Artificial Intelligence (AI) and Augmented Reality (AR) is

significantly impacting the ecommerce industry. Businesses are using AI to provide personalized

customer experiences, automate customer service, enhance ad targeting and improve

operations. Likewise, AR is creating new avenues for marketing ecommerce products, especially

in the context of social media. Ecommerce businesses that fail to take advantage of emerging

AI and AR technology run the risk of falling behind in the competitive ecommerce landscape

as consumers demand more responsiveness, convenience, and personalizations from the brands

they engage with.

Amazon: A Major Threat or a Massive Opportunity?

Amazon.com remains the leader in the industry, and has a recipe for success as seen in their

impressive 13% conversion rate, compared to the industry average of 2-3%. Looking toward

the future, amazon.com will likely remain the leader, but smaller ecommerce brands can still get

in on the action, especially those interested in products that succeed on amazon.com, including

clothing, office accessories, and electronics.

49

The Future of Ecommerce Is Now

Semrush .Trends

Semrush .Trends Semrush .Trends provides an instant overview of any market. With

competitive digital insights, businesses can identify new market realities and emerging

trends to discover new growth opportunities. With in-depth data for any website,

industry, or market across 190 countries and regions, you can pinpoint your competition,

explore their growth strategies, and find insightful audience data — all to help you get

smarter about your digital strategy.

Try Semrush .Trends now →

Open .Trends

Open .Trends Open .Trends is an open platform that gives you a high-level market

overview for any industry or geo. You can use it to find the most popular websites

across any market, unwrap in-market traffic trends, and outline the entire competitive

landscape. Browse Open .Trends →

Keyword Wizard for Amazon

The Keyword Wizard for Amazon helps you handle one of the key challenges in making

your product visible in Amazon results––finding the right search terms.

Grow with Keyword Wizard for Amazon →

50

The Future of Ecommerce Is Now